Cash Repatriation in Life Sciences: What Should You Do With it?

According to the Wall Street Journal, US pharmaceutical companies have more than $166 billion in cash overseas. A cash repatriation influx seems likely given the recent U.S. tax reform. We recommend how the pharmaceutical industry can bring that cash back from overseas and put it to use in the United States.

The question remains – what to do with it?

The last tax holiday, passed as part of the 2004 American Jobs Creation Act, resulted in about $90 billion of pharmaceutical cash (about 60% of the total at the time) being brought back from overseas. Furthermore, sustainable tax reform has been less frequent. “It’s been 31 years since we’ve had a meaningful change to corporate tax reform”, noted Johnson & Johnson Chief Financial Officer Dominic Caruso at last month’s J.P. Morgan Healthcare Conference.

Executives are vigorously reviewing their organization’s capital allocation strategy. Many have decided that the opportunity has unlocked billions that can now be used within U.S. borders. There are, of course, numerous courses of action that a company can take should they decide to repatriate.

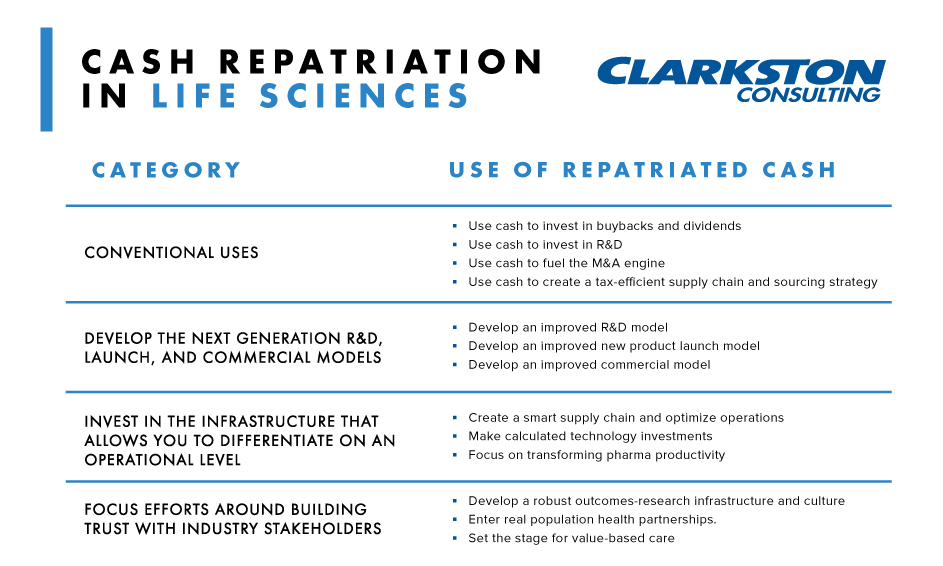

Conventional uses yield conventional results

A conventional capital allocation decision, given this opportunity, might include the following:

Use cash to invest in buybacks

Pharmaceuticals are among the top sectors for share buybacks. A 2017 study found that between 2006 and 2015, the 18 drug companies in the S&P 500 index spent a combined $516 billion on buybacks. This exceeded those companies R&D expense by 11%. Dividends also represent an attractive and related option as part of a capital allocation strategy.

Buybacks have been among the most attractive uses of funds across all sectors, but the fervor that companies are pursuing this option is of growing concern to major financiers.

“It concerns us that, in the wake of the financial crisis, many companies have shied away from investing in the future growth of their companies,” wrote Laurence Fink, CEO and Chairman of Blackrock in 2016.

Use cash to invest in research and development

Given that new molecule research and development are at the heart of the traditional pharmaceutical business model, another option is to invest in R&D activities. But looking under the hood reveals the drastic challenge that pharmaceutical companies face relating to return on R&D investments. The historic 25-30% return on R&D spend experienced in the 1990’s are no more.

Today, the IRR on pharma R&D is less than 6%, which is lower than the average cost of capital. As large pharma companies have approached and crossed this threshold, it has led to a re-imagining of the way that companies capture their early stage molecules (from in-house R&D, to outsourced R&D, to pre-commercial acquisition and partnerships). More troubling, the models are consistently predicting that the IRR will continue to shrink, and will hit 0% around 2020.

Use cash to fuel the acquisition engine

With more than $30 billion in deals in less than 30 days, 2018 has seen pharma M&A off to the hottest start of any year in the last decade. This trend is expected to continue, fueled by the new tax law, and compounded by a doubling-down on the “buy the molecule” strategy. Silicon Valley bank has predicted at least 20 or more “big exits” from biotech this year.

We are anticipating at least another $20 billion in deals over the coming months, as companies are settling on the opportunity to buy into new molecules and new platforms. CAR-T is a great example of this – over the last few months we have seen two leaders in the emerging space acquired by larger companies (Kite Pharma by Gilead Sciences and Juno Therapeutics by Celgene Corporation). Other platform technologies under development have been the focus of partnership more than acquisition (e.g., mRNA and RNAi), but even that could change with the new inflow of cash.

Not all M&A spend is optimized, which could be a focus of future investment. With the continuous push towards deal making, post-deal numbers continue to under-index stated value from due-diligence. Most flaws point to faulty integration efforts. Many points are also left on the table due to shallow due-diligence, which focuses on a few attractive variables overinflating synergies resulting in an unrealistic value target. This creates an uphill integration road with unclear objectives and principles to make it successful. Success will lie on cross-function due diligence (not just financial), and flawless transition from pre- to post-deal.

Use cash to create a tax-efficient supply chain and sourcing strategy

Beyond buybacks, R&D, and M&A, significant opportunity exists to review your supply and sourcing strategies through a new lens of tax efficiency. This exercise should go beyond a relocation analysis to a rationalization of contracting partners based on the realities of today’s labor market, global political environment, and automation / technology. New economic and regulatory policies are impacting offshoring / outsourcing and global supply. These are, in turn, creating opportunities that need to be considered holistically and not just in one silo of global organizations.

Initially, offshoring and outsourcing worked for companies who wanted to move capital assets off the balance sheet and could justify disruption to business processes because of financial gains. Now opportunity exists to look at the range of services provided such as API providers, contract manufacturing, packaging locations, customer service, back office, and IT. There is significant value to be reclaimed by savvy executives that can use their cash to create systemic improvement and long-term competitive advantage.

Using cash repatriation to move beyond convention to bold leadership

There are also less conventional capital allocation options. Given the unprecedented nature of the tax holiday, I believe that it could be an opportunity for pharma companies to take bold leadership in investing for the future.

Develop the next generation R&D, launch, and commercial

The context in which pharma conducts its three main activities is evolving. How can pharma companies innovate to stay alive?

1. Develop a next-generation R&D model

Pharmaceutical companies are approaching an existential threat related to the decreased return from dollars invested in R&D. Optimizing COGS, reallocating resources to cheaper markets, outsourcing, and buying more molecules are important, but are only incremental responses to this threat. A new approach requires the courage to look to other industries for lessons on how to transform R&D. It also requires the bravery to act and invest, spending for the long term and putting it before immediate, short term gain.

2. Develop an optimized new product launch model

In the past, if a product got to launch, it could expect to be highly profitable and fuel corporate growth. Today, it is harder than ever to navigate the complex web of activities and relationships required for success. The first twelve months after launch are the most important determinant for market success and return. As a result, an innovative approach is no longer just ‘nice to have,’ but is required to maximize the launch and ensure success during this critical stage in the product lifecycle.

Our research has demonstrated that more than 80% of launches don’t meet initial targets set by equity analysts. Greater investment in product launches, to ensure everything that can be done is being done, remains a very viable option to maximize overall return. Yet, spending more is not always better, companies must also invest smarter. In our research of more than 200 pharma launches over the last two decades, we have found that companies do not systemically apply industry best practices to each launch, and as a result, often fall into the same traps that previous launches have experienced.

3. Develop a future-ready commercial model

While it may seem that much of the low hanging fruit in commercial operations are gone, opportunities remain to drive greater market access, develop new patient services that increase the net value and velocity of treatment, and market your products in a novel way to address latent needs. For example, our research in multicultural and cross-cultural marketing has demonstrated opportunity remains to better engage with cross-cultural segments. In one case, we worked with a global pharma company to these considerations within their patient segments. Guided investment here resulted in greater than 3:1 ROI in one year.

Invest in the infrastructure that allows you to differentiate on an operational level

How do we get answered the questions that are most critical to run the business and create an ability to differentiate?

4. Create smart supply chain and optimize operations

Pharmaceutical operations and supply chain continue to be areas of potential differentiation and should be the subject of ongoing investment. With the increasing interest in personalized medicine, an influx of capital could benefit smart supply chain organizations and initialize a transition from traditional value chain models to new and unique requirements dictated by the world of personalized medicine. Those brave enough to place these bets in their new supply chains will have a significant competitive advantage that would be difficult to match. Given the importance of efficiency within the industry (especially for pharma outsourcers and wholesale), companies stand to gain substantial benefits from operational optimization.

5. Make calculated technology investments

Investment into technology solutions is essential for next-generation capabilities (i.e. outcomes research) and required to stay competitive for basic capabilities (i.e. customer engagement). Focused investment on real technology solutions focused on data can illuminate risks and create an ability to differentiate ultimately driving a business transformation. It’s critical that companies get the fundamentals right before investing heavily in emerging technologies like AI. Data integration and analytics are examples of investments companies must put in place today to unlock the promise of differentiation through more advanced technologies.

For pharma companies that conduct their own research and development, there are additional emerging technology investment options that could serve as an R&D differentiator. Many of these technologies (such as clinical trials simulation, cognitive computers, interactive documentation and visualization, laboratory robotics, and 3D bio-printing) represent a new wave of technology that drives improved lab operations and output.

6. Focus on transforming pharmaceutical productivity

Over time, you expect businesses to improve productivity, reducing their costs and resulting in earnings growth. Research has shown that the pharmaceutical sector has not seen a major productivity improvement in recent years, compared to other industries. From 2011 to 2014, the average pharmaceutical company’s cost of goods and cost of sales have held stable, and profit margins have eroded by 300 basis points to 27%. Generics have modestly reduced their cost of selling although the cost of goods has remained the same and profit margins have not seen improvement.

This unprecedented cash windfall creates opportunity for companies to spend time and money focusing on how to move the needle. One approach could be to analyze the cost drivers and conduct research on established and emerging solutions to those challenges. The key here is to not restrict yourself to look only in the pharmaceutical industry, as there are many lessons that have not yet been applied that come from other industries to improve cost of sales and cost of goods.

Focus efforts around building trust with industry stakeholders

The future of the pharmaceutical industry is value-based, patient-centric, and data-driven. How can companies position themselves to be a leader in the bold new world?

7. Develop a robust outcome research infrastructure and culture

The winning companies of the future will be the ones with the data to demonstrate the value of their therapy relative to alternatives in terms of individual outcomes, as well as larger pharmaeconomic scale. Insurance, benefits management, and pharmaceuticals are racing to be the first among the group to create a dominating place. Technology companies are also very much in the race, as companies like Apple announce massive EHR moves and Amazon continues to push forward in health, while owning the relationships with the patients.

For pharma companies to create leadership in outcomes research, it requires them to move beyond blocking-and-tackling with their partners and work to create strategic alliances for outcomes research. This is also a key step to set the stage for innovative contracts. In addition, it requires long-term thinking and investment into the infrastructure to make it possible. Finally, it requires leadership from the top to change the culture of these companies to integrate outcomes thinking into everything that they do.

8. Enter real population health partnerships

Improving population health is one of the three pillars of the Triple Aim and is of critical importance to pharma’s most important customers. Numerous hospitals and health systems are highly focused on population health initiatives. Focused investment here allows pharmaceutical companies to develop more trusted relationships with their customers by helping to solve their challenges in an authentic way. Pharma can be part of the solution to transform how healthcare is delivered and become a strategic partner in care coordination. Finally, investment here helps pharma remain patient-centric, one of the most critical activities that companies can focus on today.

9. Set the stage for value-based care

While the price of prescription drugs comprised 10% of national health spending in 2016, they remain a hotly debated topic. The responsibility to reduce system costs in healthcare remains a responsibility of all players, not just hospitals, physicians, and regulatory groups. Value-based care in the pharmaceutical industry involves the development of outcomes-tied contracts between the manufacturer and the payer.

While the industry is just beginning to explore the potential of these contracts, we believe that they represent the future of how pharmaceuticals fit into the overall US healthcare picture (and stave off disintermediation). Investment into trial runs for innovative outcomes-tied reimbursement contracts with payers will deliver learnings that will inform future pricing strategies, and demonstrate corporate leadership for the triple aim. The bottom line is that this is investing in your future business model.

What to ask yourself

The unique opportunity and challenge of deciding what to do with repatriated cash can be approached in a conventional way, or with an approach that requires bold leadership. As executives make their key decisions, we challenge them to ask:

- Do my capital allocation decisions live up to the ethos of my corporate purpose and vision?

- How can I use this unique opportunity to benefit my patients, my stakeholders, and the communities that we serve?

- Will the future leaders of our company look back on these decisions as the time we took the reigns of leadership and shaped the industry for the better?

If you would like to discuss these questions with one of our pharma industry experts, please contact Clarkston Consulting.

Co-author and contributions by Joe D’Ambrosio

Contact ClarkstonIf you are interested in more of Clarkston’s insights, please subscribe to our newsletter.

Subscribe to Clarkston's Insights

Co-author and contributions by: Joe D’Ambrosio