Navigating Growth in Cold Chain Logistics: Key Considerations for M&A and Expansion

Cold chain logistics is not a simple task; it entails the journey of temperature-controlled processes, facilities, and logistics to ensure the quality of goods throughout the transport of modern supply chains. The food industry is particularly in need of temperature-sensitive environments from manufacturing to consumption.

By leveraging technologies like refrigerated transport, insulated packaging, real-time monitoring systems, and specialized cold storage facilities, cold chain logistics safeguards product integrity, regulatory compliance, and consumer safety. Cold chain logistics is becoming one of the most important sectors in the logistics industry driven by food and beverage demand and consumer expectations for quality and safety.

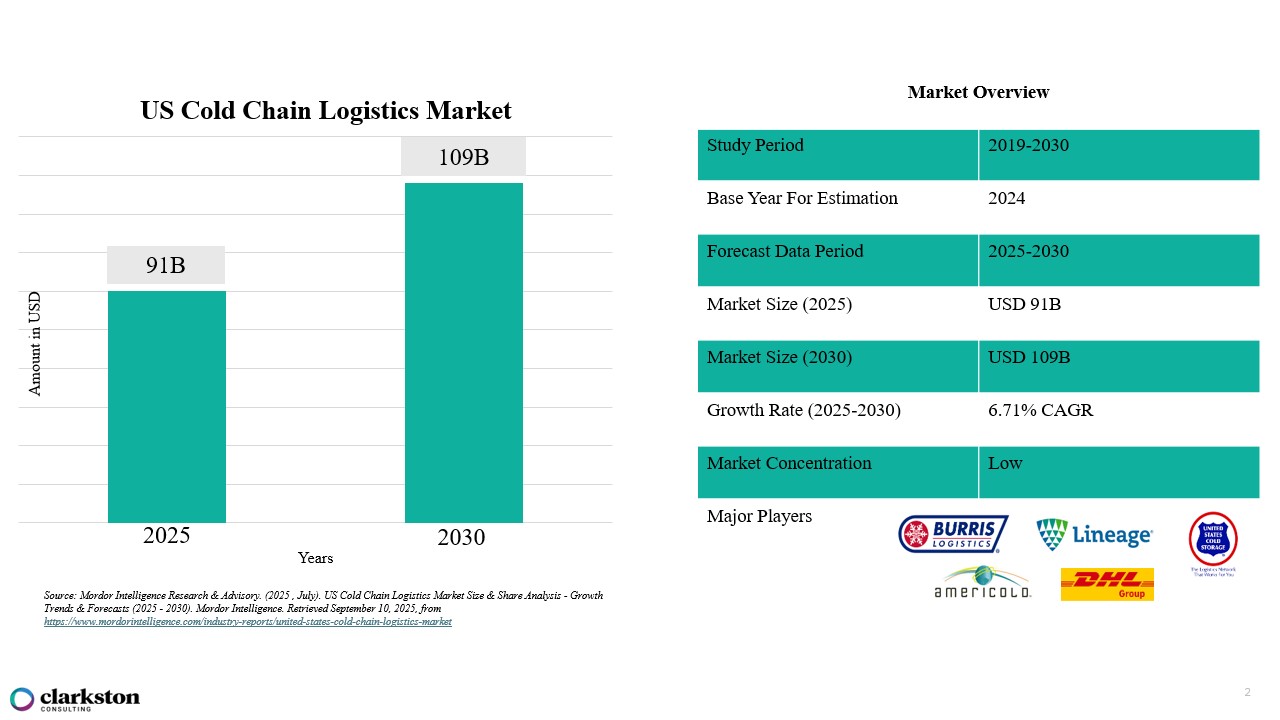

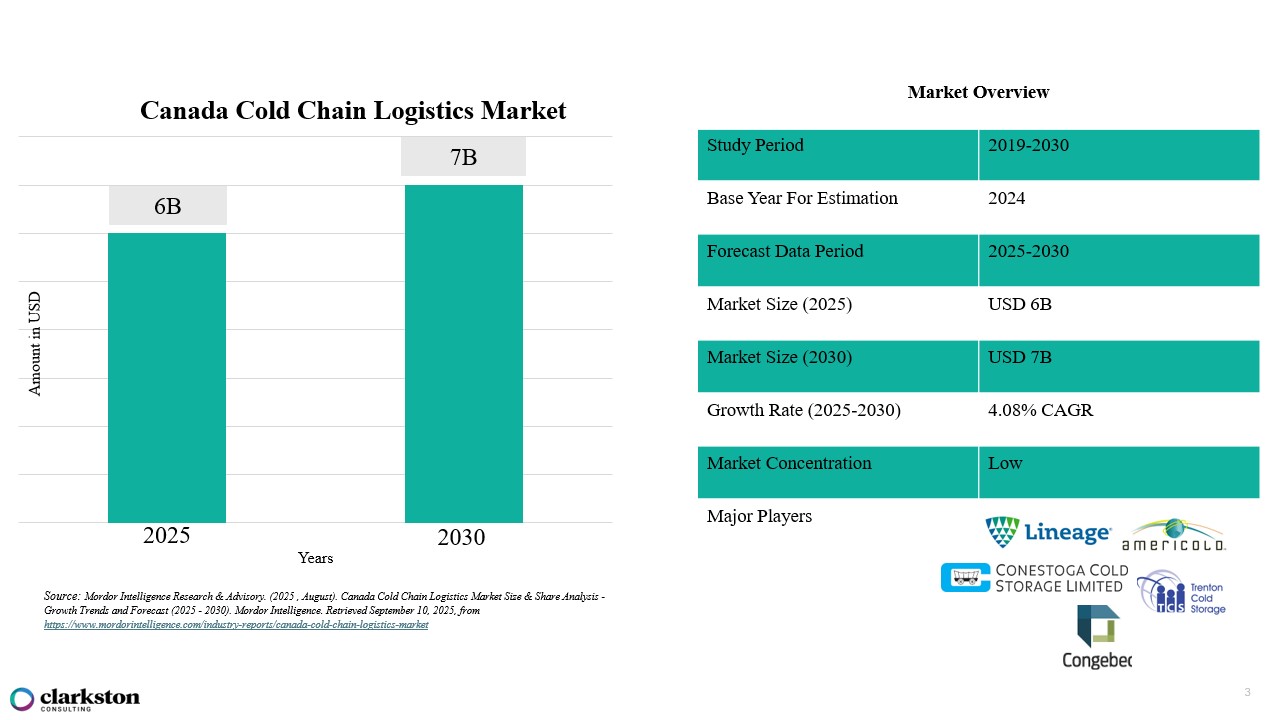

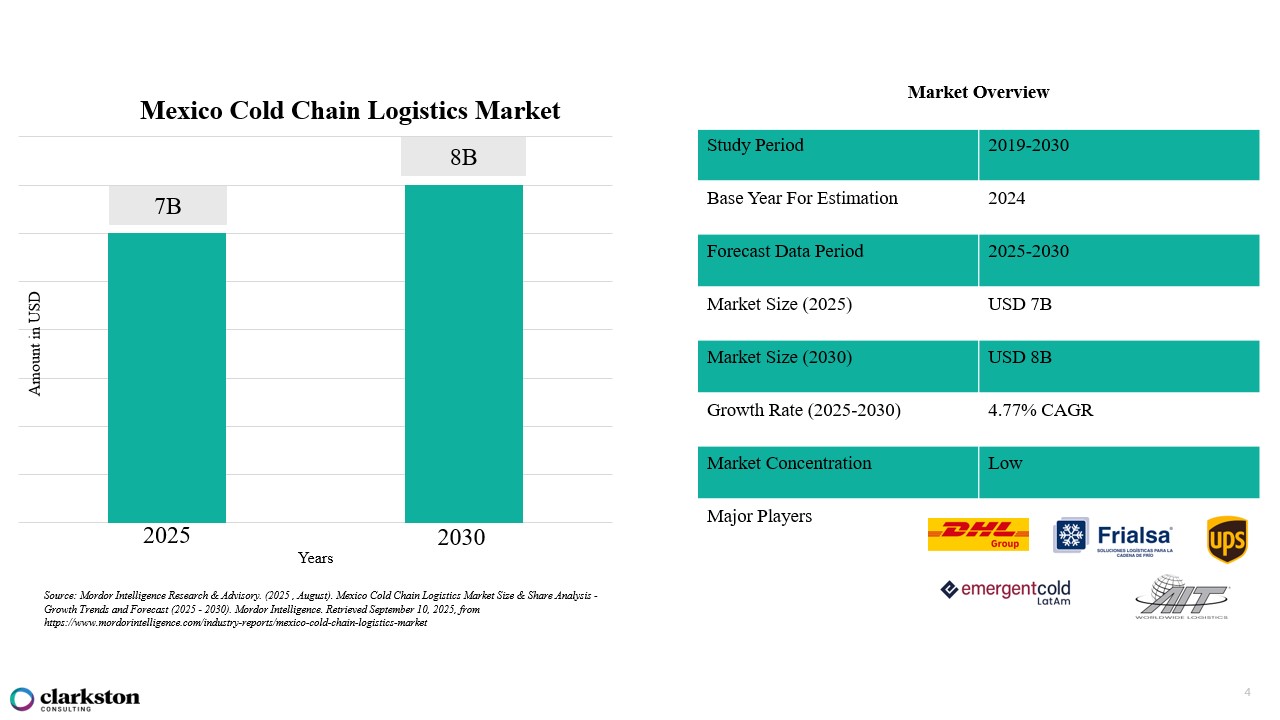

Cold Chain Market Growth Across North America

The North American cold chain market is booming:

Looking at North America, the U.S.’s cold chain logistics market size is estimated at $91B in 2025 and is expected to reach $109B by 2030; while Canada’s cold chain logistics market size is estimated at $6B in 2025 and is expected to reach $7B by 2030; on the other hand, Mexico’s cold chain logistics market size is valued at $7B in 2025 and is projected to reach $8B by 2030. This reflects an approximate $124B North American total cold chain logistics market size within the next five years.

This growth reflects the region’s expanding dominance in the industry as the need for temp-controlled perishable grocery delivery, foodservice distribution, and biologics in the pharmaceutical industry grows exponentially.

Current Cold Chain Supply Industry Leaders

The U.S. cold storage sector is highly concentrated, with just a few giants dominating:

Lineage Logistics is the largest global player with 2.1B cubic feet of cold storage capacity. Americold Logistics is the second largest, with 1.3B cubic feet. United States Cold Storage, which was founded in 1891, is a legacy leader with 405M cubic feet.

Together, Lineage and Americold control over 50% of U.S. cold storage capacity. This concentration gives them pricing power, scale efficiency, and bargaining leverage with retailers, food producers, and even investors.

New Investment Spotlights: Rising Stars

While the top three dominate, new challengers like West Coast Cold Storage, New Cold, RLS Logistics, and CJ Logistics are investing aggressively:

- West Coast Cold Storage

- Jurupa Valley, California (2024): The newest cold storage facility in Southern California, spanning 127,000 square feet, West Coast Cold Storage launched a state-of-the-art refrigerated warehouse offering immediate freezer capacity at –10 °F. The site also achieved SQF certification, Costco addendum, and organic certification, and is equipped with advanced WMS and EDI capabilities.

- New Cold

- Lebanon, Indiana (2025): NewCold has expanded its Lebanon facility, effectively doubling its capacity. The expansion added 100,000 pallet positions, bringing the total to over 200,000. The $300M investment powers one of the largest, highly automated cold storage facilities globally, driven by advanced proprietary technology and energy-efficient systems.

- McDonough, Georgia (2026): NewCold opened its first North American ambient-temperature facility (30 miles southeast of Atlanta) with 85,000 pallet positions, seven double stacker cranes, automated case picking, a rail dock, and a fully integrated drop yard. A Phase II frozen facility with over 100,000 pallet positions is set to begin operations in summer 2026.

- Hagerstown, Maryland (2027): NewCold is developing a multi-customer site with automated case picking, strategically located near major Northeast and East Coast markets, slated to open in early 2027.

- RLS Logistics

- Delanco, New Jersey (2025): RLS invested in a substantial expansion of its cold storage warehouse. This addition introduces over 6.75 million cubic feet of refrigerated space, approximately 8,000 new pallet positions, advanced refrigeration systems, and high-density racking tailored for large-scale frozen and refrigerated food distribution.

- CJ Logistics

- Gainesville, Georgia (2024): CJ Logistics opened a 270,000-sq.-ft. cold storage warehouse featuring Alta EXPERT refrigeration and QFM blast freezing (products reach optimal temperature in 24 hours).

- Kansas City (launching 2025): CJ Logistics will open a 291,000-sq.-ft., rail-connected cold storage warehouse linking directly to production facilities, designed to have access to 85% of U.S. consumers within two days.

- Seoul, Korea (Headquarters): CJ Logistics operates 12 pharmaceutical logistics hubs near Incheon Airport with IATA CEIV Pharma certification and the Cool Guardian System for real-time environmental monitoring.

Key Evaluation Factors in Cold Chain Warehousing

If companies want to invest and gain more dominance in the market, these are key attributes of a high-potential cold chain target:

Market Position & Network Coverage

The company should have proximity to retail distribution centers, ports, and food production hubs. There should be evidence of the company’s ability to serve multiple grocery/retail chains efficiently, and the current warehouse space of the possible cold chain provider target should have high occupancy rates and room for expansion.

Regulatory & Compliance

The cold chain target should have systems that are compliant with the FDA Food Safety Modernization Act (FSMA), which defines compliance requirements for handling perishables. They should also have systems that are compliant with USDA standards, which define the requirements for meat, poultry, and dairy.

Risk & Resilience Factors

Strong cold chain investment targets typically have backup systems in place, including refrigeration redundancies and generators, to prevent spoilage during power disruptions. They also maintain comprehensive insurance coverage for high-value perishables, such as meat and seafood. Additionally, they demonstrate robust recall and waste management practices, with product integrity protocols that enable full traceability throughout every stage of manufacturing and distribution.

Customer & Contract Ideal Profile

Cold chain logistics provider targets should show evidence that they can maintain strong retail and grocery relationships, serving major players such as Walmart, Kroger, Costco, and regional chains. Their client base also should include leading CPG companies, with food and beverage giants like Nestlé, Tyson, and PepsiCo relying on their services. To strengthen resilience, many providers should emphasize customer diversification, ensuring a balanced mix of clients to avoid over-dependence on any single customer.

Length of Customer Contracts

Customer contract duration directly impacts revenue stability and risk exposure in cold chain operations. Longer-term agreements secure volume commitments and support capital investment decisions, while shorter terms allow for repricing and flexibility in volatile markets. Assessing average contract length provides insight into customer loyalty and potential revenue resilience.

Current OTIF Performance

On-time, in-full (OTIF) rates are a key measure of reliability in cold chain operations, directly tied to customer satisfaction. High OTIF scores suggest robust processes and strong partner coordination. Low performance highlights risk in compliance, spoilage, or customer retention.

Facility Automation

Investments in automation provide the ability to create efficiencies and cost savings and can drive service improvements. Automation enables further space optimization, leveraging high-density racking to increase capacity within the same footprint. Cost savings are generated through reductions in labor needs, reduced shrinkage, and waste, along with lower utility costs. Service improvements can be derived from higher throughput and greater pick accuracy, while creating the ability to flex volumes higher during peak seasons or periods of increased demand.

Union vs. Non-Union Facilities and General Labor Market

Union facilities may offer more stability in workforce availability but often come with higher labor costs and stricter contract terms. Non-union operations typically have more flexibility in managing schedules and scaling labor but may face higher turnover. Overall, local labor market conditions play a critical role in determining both cost efficiency and service reliability.

Facility Infrastructure & Technology

Cold chain investment facility targets should be designed with temperature range flexibility, offering frozen zones at –20°C, chilled storage between 2–8°C, and ambient zones to meet diverse product requirements. They should also emphasize warehouse efficiency, with strong dock door capacity, cross-docking capabilities, and rapid turn handling for perishables to minimize spoilage risks.

In addition, potential companies to invest in should have advanced inventory tracking systems that integrate warehouse management system (WMS), barcoding, and RFID technology to ensure full traceability. As facilities are increasingly focused on energy efficiency and sustainability, investing in a company that incorporates low-energy refrigeration systems, solar power, and LEED-certified designs as food retailers and CPG companies push for greener supply chains is a plus.

Current Utilization & Capacity

Most cold chain networks aim to maximize capacity while leaving buffer space for seasonal surges. Underutilization indicates room for growth but can weigh on margins, while overutilization risks service delays. Understanding the balance between throughput and storage is key to evaluating operational health.

Value-Added Services Offered

Cold chain providers often differentiate by offering services such as kitting, repacking, relabeling, or cross-docking. These services can reduce handling for customers while improving supply chain agility. Providers that excel in customization often attract long-term, higher-margin relationships.

Network Optimization

Integrating new facilities into an existing portfolio requires analysis of geographic overlap and service gaps. Consolidation opportunities may lower costs while improving delivery lead times. Strategic reallocation of customer distribution locations can unlock efficiency and expand market coverage.

Systems Integration Post-M&A

Existing warehouse management systems,transportation management systems (TMS), and enterprise resource planning (ERP) systems can vary widely in compatibility, creating potential friction during post-merger integration. Cold chain-specific solutions may require tailored application programming interfaces (APIs) or middleware for smooth data exchange. Ease of integration directly affects the speed and cost of achieving operational synergies.

What 3PL Customers Look For in Cold Chain

For customers of these 3PL companies, particularly those within food/dairy sectors, the emphasis is on precision temperature control capabilities, end-to-end visibility within the supply chain, and strict food safety compliance. 3PLs looking to serve these customers must invest in reliable refrigerated transport and storage infrastructure, equipped with real-time monitoring and data integration/integrity.

The ability to maintain humidity control, minimize handling time, and manage rapid load transfers is crucial to protect product quality, especially for chocolate and dairy products that are highly sensitive to heat and moisture.

Beyond cold chain capabilities, 3PLs ultimately win by acting as true partners, not just vendors. Those who invest in relationships, prioritize service and reliability over price, and take a collaborative, customer-centric approach will consistently outperform competitors who focus only on transactional engagements.

With consolidation among top players, new investments from challengers, and a wave of technology-driven innovation, the sector is positioned for strong, long-term growth. The next decade will see more automation, greener infrastructure, and advanced monitoring systems shaping the way perishables move across the globe.

To learn more about how Clarkston can advise your organization in building resilient and future-ready supply chain networks, explore our Supply Chain Services or Mergers and Acquisitions page.

Subscribe to Clarkston's Insights

Contributions by Tamaria Samuels and Chris Podkowka