Veeva Vault CRM vs. Salesforce CRM: Considerations for Migrating or Switching Solutions

Veeva, while operating Veeva CRM on a Saleforce-based platform, identified limitations in the value the existing Veeva Customer Relationship Management (CRM) solution can deliver to their customers. As a result, the company decided to transition the CRM offerings to a purpose-built solution hosted on its own Vault platform, Vault CRM that launched in April 2024, designed specifically for the unique needs of the life sciences industry.

Veeva outlined a migration roadmap that aims to fully eliminate Salesforce instances, and all current Veeva customers would be on the Vault-based CRM by 2030. Starting in 2025, Veeva has begun to migrate instances of Veeva CRM to Vault CRM over the next five years, with most migrations occurring between 2026 and 2029.

Since Vault CRM’s launch, major players in the pharmaceutical industry have taken the opportunity to evaluate their commercial technology ecosystem and give more strategic context to the decision to migrate or switch CRMs. Some early adopters like Bayer, GSK, BioNTech, and Boehringer Ingelheim have committed to migrate to Vault from the legacy Salesforce-based solution.

As a reaction to the dissolution of the Veeva -Salesforce partnership, Salesforce announced their own development of a new life sciences CRM solution – Salesforce Life Sciences Cloud. As an established CRM leader and the former host platform for Veeva’s CRM tools, Salesforce is in a strong position to innovate the CRM landscape and challenge Veeva’s spot in the ecosystem. Partnering with IQVIA, Salesforce has leveraged the IQVIA OCE CRM solution as a starting point to develop Life Sciences Cloud as a competitor to Veeva Vault CRM.

While the Sales automation and HCP engagement functions for pharma capabilities of the solution won’t generally available until September 2025, demos of intended functionality have been rolled out over the last year signaling to potential clients how Salesforce is thinking about the new platform. IQVIA will continue to market the OCE CRM solution through 2029, by which point clients on the platform will need to migrate or switch – facing a similar decision to the Veeva CRM clients today on a similar timeline.

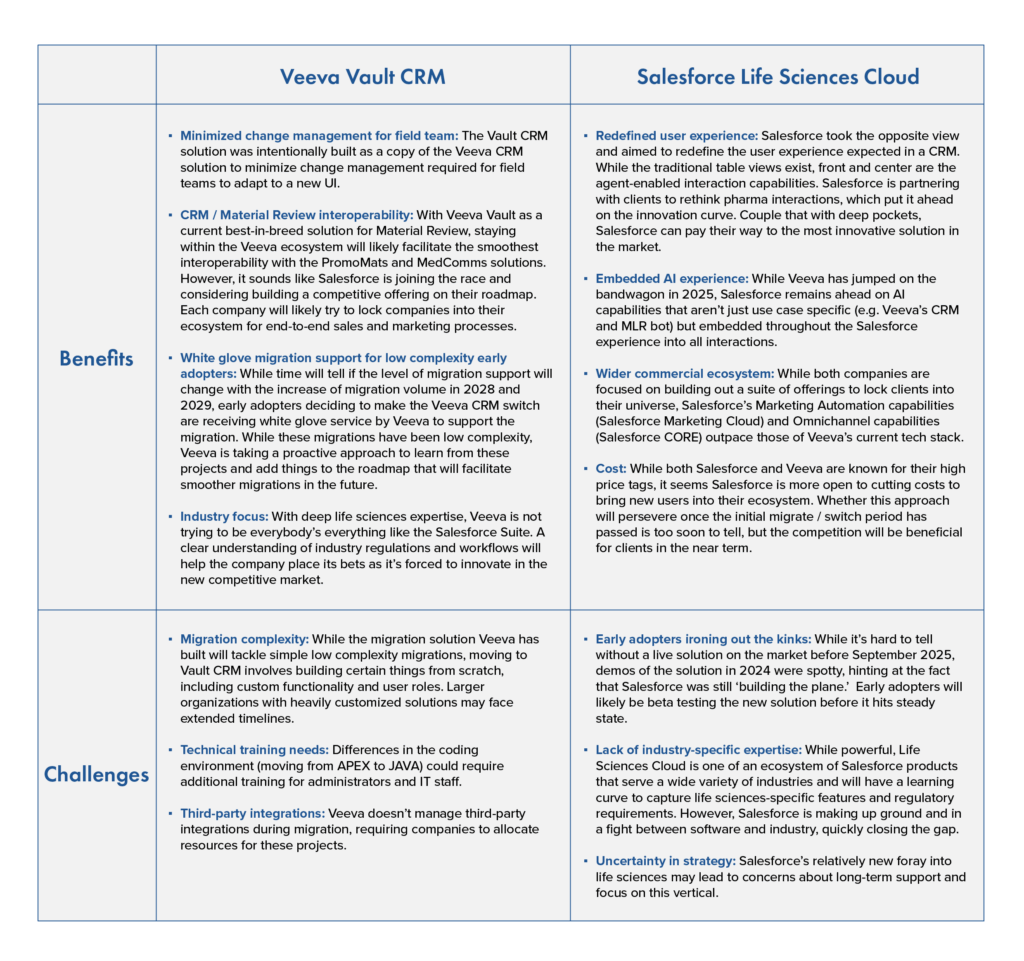

Considerations: Veeva Vault CRM vs. Salesforce CRM

Life sciences companies are at a crossroads, faced with the choice to stay with their existing CRM provider and migrate to the new solution or to use this as an opportunity to fundamentally change their commercial tech stack. Since both decisions come at a cost, many organizations are taking the time to be choosy.

Those approaching this decision strategically are taking this opportunity to reflect on their commercial strategy and evaluate their existing commercial system ecosystem and its evolution over the next 5 years. Each platform has unique strengths and weaknesses; therefore, the decisions will vary based on the organization and its current structure, needs, and openness to change. In any case, this necessary decision provides an excellent opportunity for companies to reexamine how they want to engage with customers and how CRM innovation can help them achieve their goals.

Below, we will outline key considerations life sciences organizations should take into account as they make their decision.

As pharma leaders consider their commercial IT strategy, many will look to conduct Requests for Proposal (RFP) in the coming year to evaluate options, functionality, and price. Decisions made now will likely set the course for their technology ecosystems. If you need support evaluating your technology landscape and how it best aligns with your commercial strategy, Clarkston can help.

Subscribe to Clarkston's Insights