Critical Factors for Realizing M&A Deal Value

After reaching a height of $5.8 trillion in 2021, worldwide M&A deal value dropped by 36% in 2022. A rebound in transactions is not expected in 2023, and further erosion is still likely. Despite lower overall activity, strategic investors can actually benefit from this volatile environment when valuations become more attractive.

The key lies in having a strong M&A strategy, with the right target screening elements, then ensuring maximum deal value is realized through disciplined integration – essentially managing value optimization proactively throughout the M&A lifecycle.

Many factors have contributed to lower deal activity, which is driven by a clouded short-term economic outlook; throughout 2022 to the present, there have been pervasive global recession fears associated with rising interest rates as central bankers try to tame record inflation in many regions. Higher interest rates have had a profound effect on global stock market valuations, contributing to a 17% drop in the S&P 500 Index for 2022 to mid-December. These macroeconomic factors have been further compounded by the interrelated issues of continued supply chain disruptions, the war in Ukraine, tightening regulatory scrutiny, and other geopolitical tensions.

Over the last few years, high valuation multiples and competition have made it challenging for investors to find opportunities that are a strong fit for their portfolio strategies. In particular, private equity firms will look to deploy approximately $800 billion of aging cash held in buyout funds as of late November 2022; If leveraged, this could equate to about $2 trillion of investment globally.

With lower transaction volumes and an impending recession, it’s tempting for both corporate and financial buyers to be skittish. However, these challenging conditions have historically yielded opportunities for stronger ROI and growth. During the 2008 financial crisis, Total Shareholder Return for active acquirers (firms that made acquisitions totaling at least 10% of their market cap) was 9.8 pts higher than those that were not active acquirers. Savvy investors, with strong liquidity positions and sound strategies, will be able to take advantage of a reset in valuations and lower competition for assets.

Critical Factors for Realizing M&A Deal Value

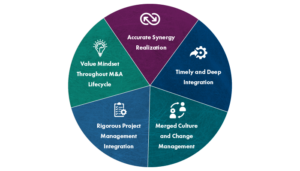

In addition to having the ability to make a sound investment in this environment, the ability to accurately measure and capture deal value is critical to success. When determining the percentage of transactions that are considered to be failures, Harvard Business Review estimates it to be a disappointing 70 to 90%. Although we understand that synergy realization has the most direct effect on delivered value, there are actually five interrelated factors that can destroy or create value within any given deal.

- Accurate Synergy Realization: The very first step to realizing value-driving synergies is to accurately forecast synergies during valuation. The second most important step is to proactively design a comprehensive Target Operating Model that will be ready to leverage on Day 1. The next step is to understand which business functions will yield the highest short-term and long-term synergy benefits and prioritize accordingly. As mentioned, every deal is different, and valuations can be more heavily predicated on revenue or cost synergies in different circumstances and industries (i.e., revenue synergies are particularly important in growth industries). Typically, the functions that yield the highest synergy value are core functions such as Sales and Marketing and anything within the Supply Chain (particularly Procurement). It’s important to note that although IT is not a core function, it’s the mechanism through which other functions find greater efficiencies and thus realize better synergies, as technology is an enabler.

- Timely and Deep Integration: Anyone who has ever participated in a transaction understands the pressing nature of pre-close activities. Once bids are accepted, diligence has been completed, valuations are finalized, and deals are structured, everyone involved takes a collective deep breath. However, the M&A lifecycle stage that affects ROI the most is integration. To fully realize synergies, and maximize values, functions must be deeply integrated, corresponding with synergy targets. Most importantly, time is of the essence, as integration timing affects when firms can actualize synergies and value. Additionally, employees tend to become frustrated and less engaged with integrations if they drag on, which becomes another impediment to integration.

- Merged Culture and Change Management: Culture and change management – what we like to call the “people factor”—are oftentimes afterthoughts, yet these components are the most common culprits of deal failures. As with synergies, culture should be well understood in the early stages of M&A activity. It’s important for both parties to be as objective and honest as possible about potential culture differences and associated risks. It’s also important to have a senior leader who will be solely dedicated to managing culture and change management on Day 0, as it really is central to integration. Change management should be rooted in clear, timely, positive, and honest communication to maximize employee retention, particularly among top talent.

- Rigorous Project Management Integration: Project management is what keeps the wheels turning during an integration, which makes setting up a formal Integration Management Office critical to deal success. It’s important to have top-down direction from leadership to teams in well-organized workstreams. Bandwidth tends to be the largest hurdle during integrations, as employees are still responsible for maintaining the day-to-day business. This is why it is so critical for leadership to understand and manage employee capacity by helping employees prioritize, as well as bringing in temporary outside help. Above all else, all project management integration activities should ladder up to the Target Operating Model and be measured by tracking KPIs.

- Value Mindset Throughout M&A Lifecycle: As alluded to throughout this piece, although integration is where the value rubber meets the road, it’s important to think about where deal value can be achieved throughout the M&A lifecycle. Successful M&A deals begin with having deliberate, evolving M&A strategies that are part of larger corporate strategies. Next, buyers must ensure that all critical components are included during due diligence. Cultural assessments are a great example of something that is key to deal success, yet rarely considered during diligence. Lastly, firms cannot afford to lose momentum during integration, as is all too often the case.

The tie that binds all of these critical factors of value realization together is the ability to combine technical, functional M&A capabilities with deep industry knowledge. Deal dynamics, particularly value drivers, are vastly different in different industries. As mentioned, revenue synergies are of a great deal more importance in growth industries, such as the life sciences, while cost synergies are often the dominant value drivers in more mature industries, such as consumer products. To properly assess, anticipate, and actualize value drivers, it’s key to deeply understand not only current and historical industry dynamics, but also future trends. You might consider partnering with a trusted industry advisor with deep M&A knowledge to assist with this.

Looking Ahead and Taking Action

Despite lower projected deal volumes in 2023, it’s possible for investors to achieve higher ROIs and advance their corporate goals. Maximizing deal value is challenging, but more important than ever if targets are to be achieved.

Strategy design, target screening, due diligence, synergy estimations, cultural assessments, IT integrations, and project management integration are critical activities that Clarkston routinely performs for clients. To chat more maximizing deal value, connect with one of our M&A experts today.

Subscribe to Clarkston's Insights

Contributions from Ramy Accad