How the Rise of GLP-1 is Impacting Apparel Retailers

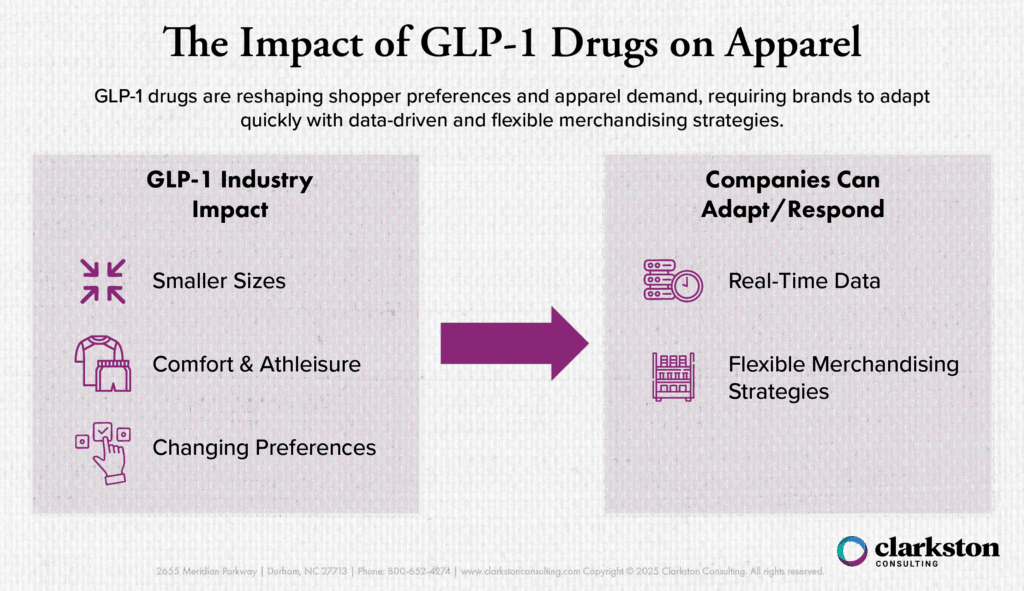

With a market projected to reach $150 billion by the early 2030s, GLP-1s are impacting far beyond the pharmaceutical industry. As usage becomes more prevalent, consumer spending patterns are beginning to shift drastically across all industries, from food and beverage to apparel and retail. Because GLP-1 drugs reduce caloric demand, grocery retailers are poised to see 20 billion fewer calories of food consumed per day and about $1.2 billion less spent on food and drink per week. A subsequent effect of the GLP-1 rise is the impact on the apparel space, as retailers adjust sizing and styles to match shopper preferences. In this piece, we break down the rise of GLP-1 trends affecting apparel retailers and how they can prepare moving forward.

Exploring the GLP-1 Impact: Apparel Retailers

Size Curve Matching & Inventory Logistics

Size curve matching is an area where retailers already struggle with efficiency, and GLP-1 usage is further disrupting inventory standards. While retailers previously followed a 1-2-2-1 ordering model – one part S, two parts M, two parts L, and one part XL – they are now shifting down to a 2-2-1-1 model. Size curve matching has historically been 20-50% accurate, so the added challenge of accurately forecasting a shifting marketing will exacerbate the difficulty of balancing stockouts and excess inventories.

Adding GLP-1s into the mix complicates inventory logistics, as individuals who lose weight might start buying new clothes to fit their changing physiques. This phenomenon of revenge shopping could present an opportunity for retailers who are prepared to adjust. These trends reverse the aftermath of the COVID-19 pandemic, where consumer demand for plus-size apparel grew rapidly.

With consumers striving to slim down again, the popularity of smaller sizes is on the rise. For instance, eveningwear brand Amarra now sells more items in the 0-8 size range than 18-24 and added sizes down to 000. In NYC’s Upper East Side, an area that leads both fashion and GLP-1 usage, sales of women’s button-down shirts in sizes XXS-S have increased by 12% and decreased in L-XXL by nearly 11%.

For apparel retailers, these logistical challenges will have significant financial impacts. Retailers who are unable to respond with inventory adjustments risk margin erosion if markdowns on larger sizes become necessary. A fashion retailer with $1 billion in annual sales could lose up to $20 million in margin and an additional $20 million in unrealized sales from size curve inaccuracy. It’s essential to anticipate continued demand shifts as more consumers start taking GLP-1 drugs.

New Style Preferences

GLP-1 users aren’t just changing sizes – they’re changing style preferences as well. While loose-fitting garments have been in style for several years with baggy jeans and wide leg trousers, this trend is giving way to tight fitting and edgier clothing. As GLP-1 users lose weight and shrink sizes, they’re opting for tighter garments. Rental clothing companies are also experiencing the effects of these shifting styles, with Rent the Runway reporting a rise in pieces with cutouts and other similarly revealing features.

The full impact of this style shift remains unclear, but retailers recognize that GLP-1s may pose risks for baggy or oversized clothing lines. For example, Tommy Bahama expressed concern that its “Big and Tall” collection for men might see reduced sales in the future. Paying attention to shifting consumer preferences is crucial as shoppers develop newfound confidence in their bodies.

At the same time, comfort continues to be a key priority. 40% of GLP-1 users agree that they’re now more likely to shop for comfort, placing only secondary focus on experimentation and trends. This indicates that customers expect not only form-fitting attire but also a complete range of apparel options for any occasion. Retailers must walk the line between aesthetics and functionality in the age of the GLP-1 consumer.

Athleisure is another area for retailers to watch, as the percentage of GLP-1 users exercising weekly doubled from 35% to 71% after taking the medication. These newly active lifestyles are likely to drive spending on athleisure items and running shoes that reinforce healthy habits.

How To Prepare

The rapid consumer shifts driven by GLP-1 usage require strategic responses from apparel companies. To better align inventory with demand, retailers should monitor real-time data on product performance. This data helps with size curve management and can be used to build personalized recommendations that attract repeat customers.

Brands can also benefit from altering product lines to appeal to individuals pursuing a weight loss journey. While some customers are increasingly selecting more fitted clothing items, others might appreciate adjustable items that can be tightened and loosened for different physiques.

With 47% of GLP-1 users viewing fashion more favorably since starting the medication, the time is now for retailers to market themselves as a tool for transformation and self-expression. By meeting shoppers wherever they are, apparel retailers can position themselves at the forefront of the GLP-1 fashion evolution.

If your apparel business is interested in learning more about implementing these strategies, contact our experts here.

Subscribe to Clarkston's Insights

Contributions by Hannah Yang and Bella Gordon