4 Tips for Making the Rx to OTC Switch

Since the antihistamine brompheniramine maleate (i.e., Dimetapp today) made the switch from Rx to OTC in 1976, 115 more products have followed seeking growth opportunities.

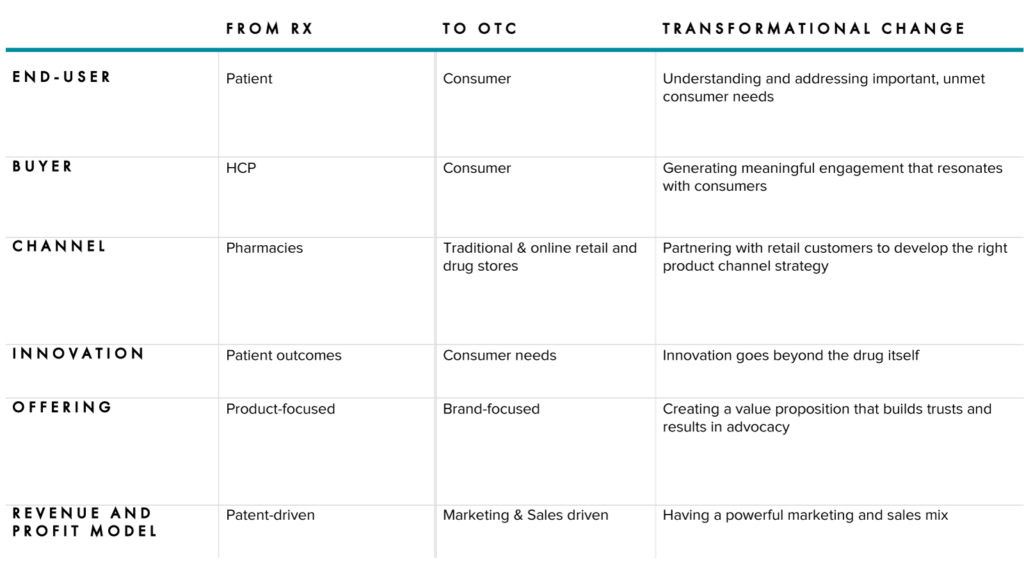

When considering an Rx to OTC switch, success will depend on your company’s ability to embrace the differences in the Rx and OTC business models. At the heart of the switch is shifting the focus from patients to consumers. As the product moves to the consumer healthcare industry, the team must learn to innovate, advertise, and sell to the consumer while operating with agility in a highly competitive and dynamic market.

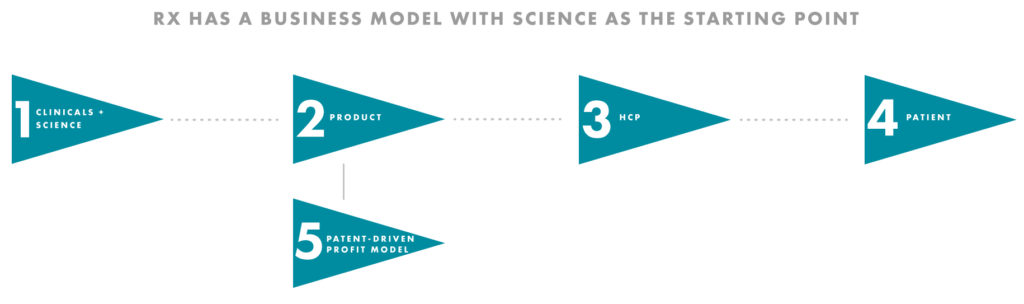

Put simply, the Rx model starts with science to improve patient outcomes, with the clinical results playing a key role. Whilst the patient is at the heart of the company, the end-buyer and key decision maker is generally still the health care professional (HCP).

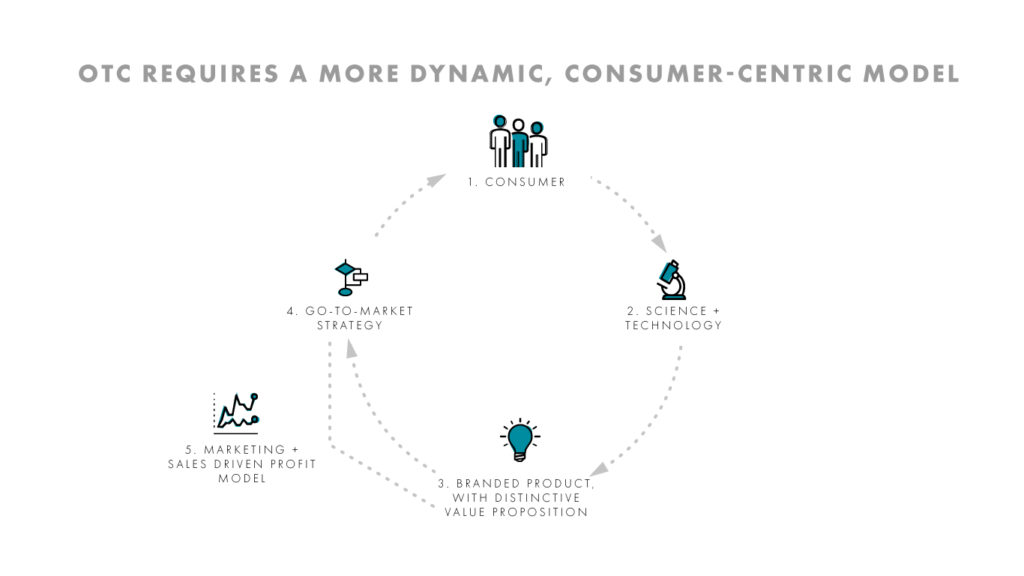

In over-the-counter treatments, the consumer is both the end-user and the buyer. This calls for a dynamic, consumer-centric business model addressing important, unmet consumer needs. This approach will feed into science and technology to enable innovation that creates meaningful solutions to consumers that go beyond the drug itself (i.e. flavor).

Next, branding is critical to build trust with consumers and to ultimately obtain consumer advocacy. The go-to-market strategy requires strong marketing and sales commercialization plans tailored to the consumer, while also considering the business needs of retail customers. It’s this powerful marketing and sales mix that will ultimately drive the revenue and profit model, including but not limited to the product. Success in OTC means the consumer sits at the heart of the business model.

4 Considerations to Guarantee a Successful Rx to OTC Switch

To ensure a successful Rx to OTC switch transformation, product teams must change how they innovate, advertise, and sell to consumers.

1. Model

From B2B to B2C

While Rx always has the end-user – the patient – in mind, the HCP retains significant influence as a decision maker. For OTC, this is entirely different as that influence rests entirely with the consumer. This doesn’t mean there’s no role for the HCPs to play as influencers – however, the strategy must revolve squarely around the consumer. As is the case in the industry, consumer-centrism is a critical organizational quality for any modern consumer goods business. Some organizational capabilities to consider:

- The consumer is central to all major decisions and the starting point for all strategies, including technical and/or commercial strategies. Everyone in the organization should know and understand the consumer intrinsically.

- The B2C sales landscape is very different from B2B, and sales and account management will have to understand their new customers and new rules of the game (e.g., eCommerce, trade promotion).

- The marketing and sales mix will be the key driver for the profit model, including important capabilities such as product portfolio, product-channel, and pricing strategies.

2. Innovation

From Improving Patient Outcomes to Addressing Consumer Needs

Innovation will always be important to Rx and OTC, however there are some differences in the role Research & Development plays. In Rx, innovation is focused on improving patient outcomes. In Rx, a good innovation is patented, unique, and will sell itself using the science behind the clinical trials. In OTC, innovation must be driven by consumer needs, which are driven from consumer insights, to appeal to consumers. On the OTC side, even the best innovations may fail if they are not positioned correctly and marketed with a best-in-class commercialization plan. Operationally, businesses will need to ensure strong cross-functional collaboration throughout the entire innovation and go-to-market processes.

3. Advertising

From FDA to FTC

In Rx, the U.S. Food and Drug Administration (FDA) is the body of jurisdiction and all advertising materials need to be filed with the FDA. For OTC, the Federal Trade Commission (FTC) has jurisdiction of advertising and it is more about claim substantiation rather than, for instance, full complex clinical analyses. This creates a very competitive OTC environment, where companies are constantly trying to maximize the claims they can make.

For companies considering the Rx to OTC switch, staying competitive and relevant means a different approach to advertising, one that stretches well beyond the typical advertising activities in the pharmaceutical industry. Operationally, businesses should ensure they have the internal capabilities to understand the implications of this advertising jurisdiction change from the FDA to the FTC.

4. Market Effectiveness

From Maximizing Patents to Market Agility

Without the protection of patents, and with the increased room-to-play from an OTC perspective as claims fall under FTC’s jurisdiction, competition is aggressive and fast-moving in the OTC category. Businesses need to embrace market agility, enabling them to stay relevant to the consumer. This differs from Rx, where market effectiveness revolves around maximizing the patent, clinical trials, and science behind the product. Key operational implications include:

- Agility, speed, and flexibility in the new product development and go-to-market processes

- Cross-functional collaboration to capture consumer needs and translate this to fast go-to-market strategies

As trends in consumer healthcare continue to reflect consumer desire for more self-direction in their own wellness and self-care, businesses making the Rx to OTC switch can enable better options and greater value for the consumer. Despite the commercialization challenges related to making the Rx to OTC switch, this transfer of FDA-approved prescription medications to nonprescription is a cost-effective way to provide access to safe and effective medicines to consumers. As more pharmaceutical companies make the Rx to OTC switch, the consumer healthcare industry has the potential to save the healthcare industry significant costs, as each dollar sold on OTC medicines saves more than $7 for the U.S. healthcare system.