Leveraging the New York Fed Supply Availability Indexes to Better Measure Disruption

On May 20, 2024, the U.S. Federal Reserve Bank of New York (New York Fed) announced it will begin launching new Supply Availability Indexes (SAIs) in June. The new indexes will complement the New York Fed’s Global Supply Chain Pressure Index (GSCPI) and are meant to “present a new gauge to measure disruptions (while having) the advantage of being released early in the month as part of (the Fed’s) regular regional business surveys before many other indicators are available.”

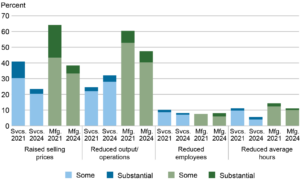

Able and Deitz’s (New York Fed’s Research and Statistics Group) report shows that while progress has been made to better respond to supply chain disruptions, businesses remain impacted and are coping with these issues in various ways. Four key areas, in particular, have remained levers across service and manufacturing companies in addressing those disruptions: raised selling prices, reduced output/operations, reduced employees, and reduced average hours.

Actions Taken Due to Supply Chain Disruptions

Source: Federal Reserve Bank of New York, October 2021 and May 2024 Supplemental Surveys.

Leveraging the Global Supply Chain Pressure Index (GSCPI) and Supply Availability Indexes (SAIs)

The GSCPI has helped provide clearer correlations between the purchase price index (PPI) and the consumer price index (CPI) against not only the U.S., but also against Europe and the rest of world. Adding the SAIs, which are developed using manufacturing and service industry leaders’ feedback, into the analysis will allow life sciences, consumer products, and retail companies to leverage both indexes to evaluate economic demand and supply developments in a more succinct manner.

For example, when oil prices and transportation costs shift, consumer products and retail companies are significantly impacted. This shift can increase the price of inbound freight; as it falls, the availability of containers and ship space is reduced. Being able to use this information in a company’s predictive analysis could assist in planning potential shortages or cost increases. These indexes can also assist in determining the “right” time to increase or decrease prices or implement promotions. While many companies have this as an annual process, leveraging the information from these indexes can assist in determining if a price adjustment could be used as a marketing lever. It can further help to explain the “why” to customers if a price increase is required.

Within the life sciences industry, these indexes can provide visibility to global market dynamics, including labor, price, and availability. As life sciences companies evaluate the impact of the BIOSECURE Act, these indexes can assist in comparing China’s contribution to the global and/or U.S. GSCPI and SAIs. The ability to compare information can also further support risk mitigation strategies.

It’s important for supply chain leaders to understand that when the global supply chain faces any pressure due to natural disasters, political tensions, trade disputes, etc., it can lead to product insufficiencies, from finished products to raw materials, causing the GSCPI to fluctuate. Thus, the need to use these more advanced modeling tools becomes necessary to make more informed decisions.

In June 2024, the SAIs will begin being published on the fourth day of every month along with the GSCPI. Companies will be able to use these indexes to gauge how important supply constraints are with respect to economic conditions and better understand how those constraints evolve over time. The SAIs will present a new method to measure widespread supply disruptions, understand if availability is improving, and track inflationary pressures and the impact on local operations. Together with the GSCPI, the SAIs can also be used to compare trends in the U.S. to international supply availability and provide an overview of potential supply chain disruptions.

Incorporating the New York Fed Supply Availability Indexes into Your Supply Chain Strategy

Clarkston’s supply chain experts believe the SAIs and the GSCPI are great tools to support an organization’s decision modeling. While large companies often have economists on staff to help them understand the global economy, monitor supply chain disruptions, and spot potential backlogs, this isn’t the case for others. Without this insight, it’s difficult to know what external factors to incorporate into a company’s Integrated Business Planning (IBP) / Sales & Operations Planning (S&OP) process and its risk and resiliency modeling.

Below are tips on how businesses across industries could use these tools:

Tip 1: Be Prepared to Respond to Volatility

Although your business can take certain actions to respond to short-term changes in supply chain-related components, global disruptions make it more important than ever to position the supply chain for the long haul, too. Firms can use the inputs from the GSCPI’s economic research to respond more effectively to supply chain volatility.

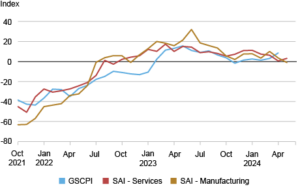

As shown in the below graph, while there was an improvement for roughly the last year and a half, SAI-Manufacturing appears to have stalled. It therefore becomes important for companies to become familiar with how to read, interpret, and utilize this information.

Supply Availability Indexes Capture Global Supply Chain Disruptions

Source: Federal Reserve Bank of New York.

Notes: GSCPI is Global Supply Chain Pressure Index. SAI is supply availability index.

Tip 2: Manage Inventory More Effectively

Inventory costs can be a major drain on profitability, so it’s critical to manage this factor efficiently. In response to certain shortages, some retailers and businesses may have procured too much inventory and may now be exposed to potential declines in buying patterns in the coming months as the global economy continues to fluctuate wildly.

Tip 3: Embrace Anti-Fragility

The pandemic and other geopolitical events have highlighted just how fragile the global shipping infrastructure can be. This was particularly evident following the Francis Scott Key Bridge collapse, which has shut down the largest east coast auto port. Because of COVID, companies have learned the importance of being agile, but they should also pursue anti-fragility, as this idea embraces randomness and uncertainty to improve – not just resist and stay the same. The GSCPI and the SAI will also assist as early-warning trending mechanisms for supply chain leaders and organizations.

Tip 4: Incorporate Indexes into IBP/S&OP Processes

With the use of the GSCPI and SAIs, organizations can implement forward-looking analytical measures into their IBP/S&OP process. By understanding how much shipping costs and transportation delays will impact the ability to sustain profitability – from changes in global demand and supply, to supply shortages, to global pricing changes – companies will be better equipped to adjust their risk and resiliency strategies.

Next Steps

Clarkston’s supply chain experts have extensive experience in helping companies better manage their supply chains. We can help your company understand, identify, and recommend improvements to reduce your supply chain risk and improve resiliency. Our team can further assist you with incorporating the Fed’s new Supply Availability Indexes into your supply chain processes. Reach out to us today.

Subscribe to Clarkston's Insights