Research Brief: Analytics & Insights Indicator

Data. As a Consumer Products professional, you are probably swimming in it. Syndicated, POS, loyalty, coupon, survey data – not to mention the flood of social media data coming your way. However, for most CP organizations, the issue is not about the volume of data or even access to it. The challenge lies in turning those data inputs into actionable insights that could drive your business forward. It is about using that data to:

- Make smarter decisions

- Measure your success

- To know what is working and what is not

Currently, a company’s ability to measure success is often limited by its focus on traditional, financial-based metrics: revenue growth, company profitability, earnings per share, etc. No proven KPIs exist that allow an organization to measure their success in Analytics, and very few benchmarks are available to gauge organizational capabilities. When organizations attempt to gauge their analytical prowess, they might evaluate their analytical tools and, perhaps, the number of analysts and statisticians employed. However, this fails to consider a more holistic measure, one that views organizational behaviors and processes equally important as resources and tools.

Analytics & Insights Indicator

To fill this void in the industry, Clarkston Consulting developed the Analytics & Insights Indicator to provide a comprehensive view of Analytics for the entire organization. Gathering survey data from approximately 100 Consumer Products professionals, Clarkston assessed companies’ analytical capabilities around Strategy, Process, Organization and Technology (SPOT), providing recommendations across all of these areas. The following research brief summarizes these findings.

Key Findings

For a company to reach its full analytical potential, they must align their analytical capabilities with corporate strategy. Thus, addressing these execution issues now is critical, as the challenge will only get more challenging as big data continues to roll in. Highlights of these key findings include:

The Biggest Gap Lies Between Strategy and Execution

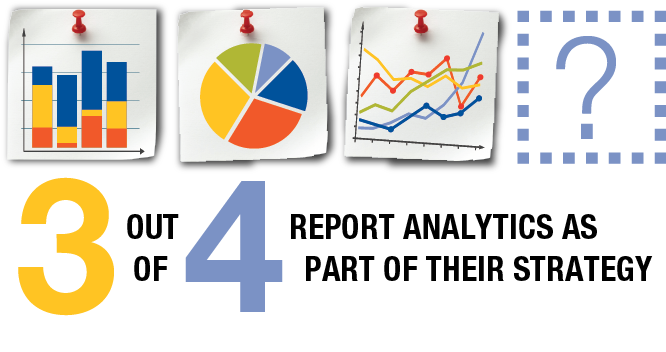

Companies continue to struggle with the best ways to get the right information in the hands of the right decision makers. Three out of four respondents reported Analytics to be a key part of their strategy, confirming that the topic is clearly on the mind of top industry executives. However, almost half of the respondents felt their organization is not aligned around key performance metrics, indicating that simply including Analytics in your strategy does not guarantee that the right things will ultimately be measured.

Survey respondents also – regardless of whether they reported Analytics within their corporate strategy – rated their company’s ability to compete in the market with Analytics as “somewhat ineffective.” On top of that, over 60 percent of survey respondents do not feel as if their company has a specific, structured plan around how to integrate big growth in data.

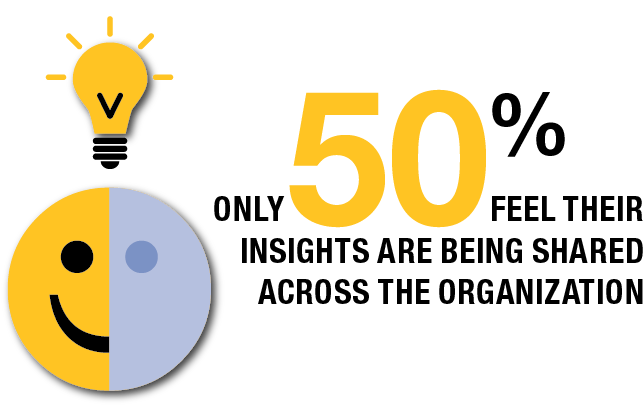

Companies Struggle with Sharing Data Across the Organization

Most companies do not have a centralized Analytics group within the organization to help drive strategy and execution. Our research concludes that the majority of companies are not leveraging analytics to drive their functional processes.

Most companies feel they don’t have the right people to support Analytics. With the right processes in place, CP companies need to ensure that they have dedicated people in place to analyze and interpret the data in order to extract insights. Yet, despite the fact that Analytics is so important at a strategic level, very few companies have the right organizational structure and people in place to realize success. Most organizations feel they do not have the right analytical ‘talent’ to support their organizational needs. In regard to the capabilities of individuals, only 30 percent of

respondents feel that their company has the right people in place to support their Analytics needs.

Companies Have the Tools to Analyze Their Data, But Can’t Do it in Real Time

The right Analytical tools can save you a lot of time and headache. But, are you using the right ones? Are they giving you information that you can really use, when you need it?

Survey respondents didn’t seem to have an issue with access to technology. These days, the majority of CP companies have a centralized data repository in place, capable of housing huge volumes of downstream data inputs. Capable may be the key word here. Companies may have the right tools in place, but a staggering 50 percent of them are planning to invest in augmenting those tools within the next 2 years, focusing on the ability to provide ‘real-time’ data analysis.

For more, please download our report.