Value-Based Arrangements: The New Normal in Biotech

Why have value-based arrangements been so slowly adopted in life sciences industries? What might the future model look like? These are questions that companies across the industry are vigorously debating as we speak. After all, value-based care seems to make sense and represents something that many other industries offer – a money-back guarantee on services not rendered.

While it seems utopian to some, a few companies have stood this business model up in the market, and are the first examples of the model in action (see Spark and Alnylam). Many other life science companies have taken note, but write this off as something to keep on the radar to think about it in “a few years”. In our experience, these companies lack alignment on the reasons that the model should be implemented in the near term.

The reasoning behind the reluctance to change is understandable. The shift represents a significant change to established business models and is perceived to threaten the top and bottom lines. The decision to pursue a value-based model is at the heart of both a brand strategy and the enterprise strategy. Inside the organization, the decision has far-reaching impacts to strategy, operations, and technology – not to mention the major market impacts.

Allow us to share our perspective on three reasons that value-based arrangements will become much more common in the industry over the next decade.

Reason 1 – Value-based arrangements are a strategic lever to differentiate commercially. Incumbent products will increasingly use that lever to compete against more personalized medicines.

Personalized medicines are already making major waves throughout the industry. From a clinical perspective, these products are highly differentiated – using someone’s own genome or cellular mechanisms and targeting specifically to those individual attributes.

While today, personalized medicines are approved in only a few categories for a few indications but this will change significantly over the next few years. Companies with broad portfolio ambitions are investing billions into personalized medicine, cellular therapy, and gene therapy.

Eventually, it will come to a point where personalized medicines are available in several categories that traditional products currently inhabit, beyond rare diseases. The new-to-world personalized medicines will offer significant clinical differentiation over the incumbents.

If you’re the incumbent, how can you further differentiate your product? Since you can’t change your clinical data, you will look to increase the commercial attractiveness and “sweeten the deal” for payers.

It is this competitive imperative that will drive mass-market uptake of value-based models in biotech and pharmaceuticals for non-personalized products.

- Personalized Therapies: As they launch, many more personalized therapies will use value-based arrangements to justify the price-point required to earn ROI on their invested R&D capital, further differentiating from traditional products.

- Traditional Biotechnology/Pharmaceutical: The competitive paradigm described above will drive greater acceptance of the value-based model. The winners will be those that choose to act on this model before the competition and demonstrate true patient-centricity to payers. Without it, differentiation will become harder and harder as the competition closes in from new angles.

- Generics and Biosimilars: For the foreseeable future, generics will continue to fight tooth-and-nail on volume strategies. In time, the generics industry will be gathering data from the commercialization and operation of value-based models in non-generic settings. Pairing that data with digital health technology will allow innovators to create broader-scale innovative contracts with payers.

Reason 2 – Innovation is not limited to the clinical setting; commercial innovation is a requirement for acceptance with future payers, providers, and patients

Looking over the last many decades there have been only incremental changes in the life sciences commercial model. For example:

- The sales model has remained mostly the same, with the addition of contract sales forces and hybrid models for specific opportunities like co-promotes. Companies frequently try and fail to design more flexible, effective salesforces as doctors continue to shut their doors to reps.

- The marketing model has remained the same as well (if you need any proof, watch the commercials). Marketers have added some new tools and have new digital channels to work in, but in our experience, most companies continue to market to their customers with twentieth-century marketing skillsets.

- The brand teams have gotten better at managing and optimizing a drug over its lifecycle, but new product launches continue to be one of the top challenges in every life science organization, as half of all launches miss financial expectations by 50% or more according to our research.

- The market access model has experienced significant change over the last decade – the practice has been formalized as payers and PBMs continue to gain leverage over others in the system. In fact according to industry surveys, 5x as many executives cite payers as the most influential healthcare partner compared to ten years ago.

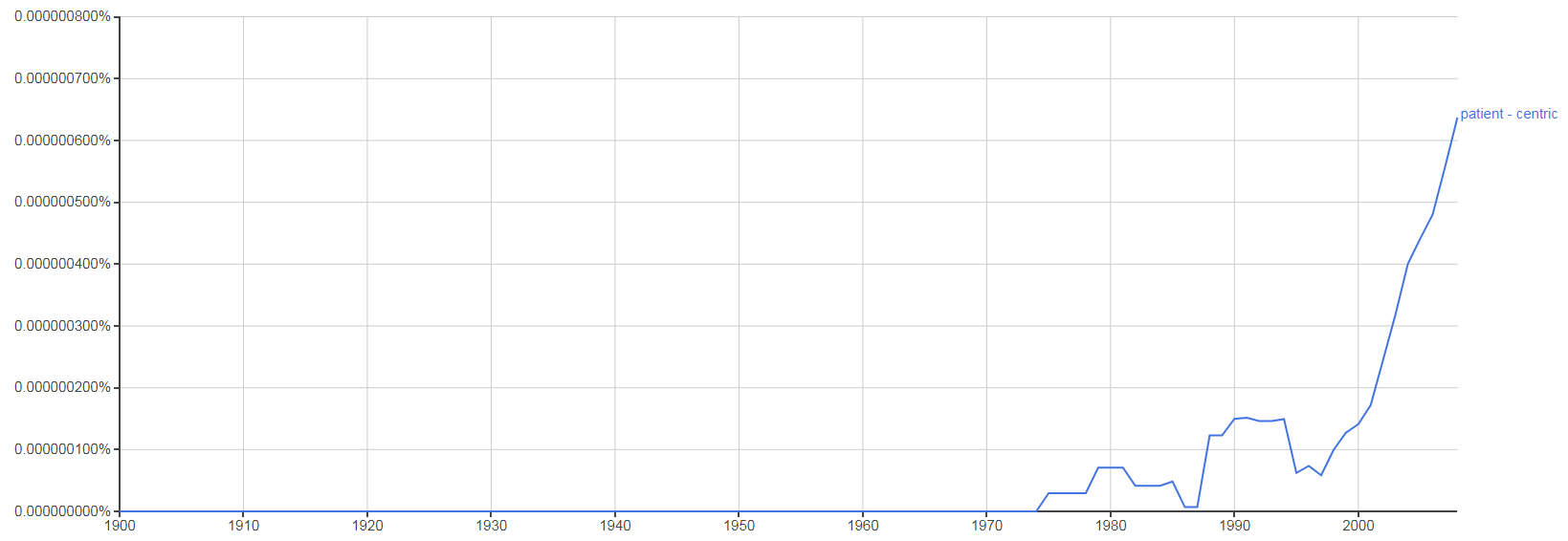

At the same time, life science companies have increasingly communicated their intent to be a patient-centric company to the market.

Use of the Term “Patient-Centric” Over the Last 100 Years

If life science organizations want to become truly patient-centric, it means they must be willing to authentically listen to other stakeholders in the healthcare ecosystem and offer to change and work together to better align both organizations to the patient.

Achieving that will require a step-change in the way that sales, marketing, brand teams, launch, market access, and patient services teams operate. Value-based arrangements represent an opportunity to initiate that change because it pervades every element of the commercial model.

Companies are starting to figure out how to effectively operate value-based models in the market. The first wave of companies born into the age of the patient are maturing to the point where they are launching their first products. They are blazing a trail many will follow.

Reason 3 – In the age of information – transparency and simplicity are new key value disciplines

When working with our broad base of life sciences clients, we frequently hear “but we’re healthcare, we’re different! Other industries cannot be compared!”

This type of industry hubris is dangerous. While there are some material differences in healthcare compared to other industries, an inability to look outside, extract themes and best practices, and find ways to apply them inside healthcare means you are leaving yourself open to disruption. We frequently help our clients to evolve their thinking and integrate creative thinking of this nature into their strategies and teams.

In every other industry, simplicity and transparency are becoming critical value disciplines. Companies that are simpler, or more transparent than their competitors are winning in almost every industry. Results are plain to see. The industries that are convoluted and opaque are being disrupted. It is not a matter of if, it is a matter of when.

A value-based model requires a new level of transparency and offers an opportunity to step up how simply they convey their message to the market. It is something that patients, payers, and providers care about.

The same way that companies in other industries are looking to build experiences beyond the products themselves, commercial organizations need to think through every element of their approach to patients and understand that every action or inaction sends a signal. In the information age, you cannot afford to not be patient-centric.

If manufacturers are trying to foster trust with partners, this represents the largest opportunity available to do it. Offering to be innovative with these companies and put skin in the game is bold and the market notices. On top of that, partnerships across industries will be increasingly important over the next decade as returns on R&D continue to go down.

Parting Thoughts

If your commercial organization is not considering value-based arrangements today, a key differentiator is hiding in plain sight. The ability to envision, plan, or commercialize value-based models is not the stuff of sticky notes on the wall. Pioneers are proving that the model is viable in the real world.

If you would like to explore the opportunity of a value-based model for your brand, contact us.