Drug Shortage Series: Exploring the Impact of Drug Shortages in the Generics Industry

Drug shortages in the U.S. continue to affect patients daily. They range from something as simple as buffered aspirin to life-saving medications such as cancer chemotherapy agents, antibiotics, and epinephrine. In the third piece of our Drug Shortage Series, we explore the impact of drug shortages in the generics industry. You can read the first piece on an overview of drug shortages in the U.S. here and the second piece on common causes of drug shortages here.

Drug Shortages in the Generics Industry

As we further explore drug shortages, we dive into the generic industry, its challenges, and how they’re related to ongoing drug shortages. Outside of capacity constraints and manufacturing delays, there are nine common classes of products that are being impacted. The top five being, in order, central nervous system (CNS) agents, antimicrobials, hormone agents, chemotherapy, fluids, and electrolytes. We can further separate these into further categories, with the largest group of drug shortages being within the generics industry.

Shortages of prescription generic drugs account for nearly 90% of prescriptions. The challenge is this group of drugs has been more frequent and can last for several months or even years. A recent study shows that from 2017 to 2021, the U.S. Food and Drug Administration (FDA) received 731 manufacturer “supply chain issue reports,” which are meant to identify shortages that could affect the national supply of an important prescription drug. Of those, 113 drugs had a “meaningful” shortage, defined as a reduction of 33% or more in the quantity supplied within six months of the issuer report compared with the preceding three months. A substantial majority of these shortages were for drugs where generics are available, a majority lasted for more than a year, and the median age of the drug was 17 years.

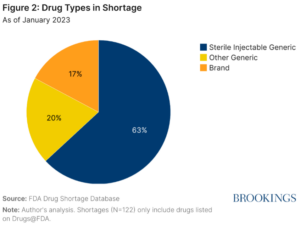

Using the 2023 FDA Drug Shortage Database, Brookings classified drugs into three separate categories. Generic injectables have posed an ongoing challenge over the past 20 years. MedScape identified four contributing areas injectable drugs have seen a consistent shortage. First, there are a small number of generic injectable manufacturers, currently limited to seven. Second, there’s a lack of redundancy in manufacturing for generic drugs. Third, the manufacturing process is complex. Lastly, many of the generic injectable products are older drugs that are sold very cheaply and with low-profit margins.

Using the 2023 FDA Drug Shortage Database, Brookings classified drugs into three separate categories. Generic injectables have posed an ongoing challenge over the past 20 years. MedScape identified four contributing areas injectable drugs have seen a consistent shortage. First, there are a small number of generic injectable manufacturers, currently limited to seven. Second, there’s a lack of redundancy in manufacturing for generic drugs. Third, the manufacturing process is complex. Lastly, many of the generic injectable products are older drugs that are sold very cheaply and with low-profit margins.

More recently, in early 2024, the U.S. Pharmacopeia (USP) identified shortages have been caused by “economic pressures, especially the very low prices that generic manufacturers recover for many medicines, along with contracts that are frequently broken”. In their opinion, this has left the generic medicine supply chain fragile.

Adding to these constraints is a limitation to produce the required Active Pharmaceutical Ingredients (API)s due to controls put into place by the DEA (Drug Enforcement Administration). An example is for Schedule II drugs that treat attention-deficit/hyperactivity disorder (ADHD). ADHD drugs have seen a multi-year shortage, which according to physicians, lowers quality of life for patients.

Currently, the process followed is that manufacturers must provide the DEA with actual sales so the DEA, who controls the production levels of these controlled APIs, can develop the demand requirements to prevent excess supply that could find its way to the black market. However, shortages continue within the market.

This has led to physicians, pharmacists, the FDA, and the DEA, along with drug manufacturers, to question what can be done to resolve these shortages. There are differing perspectives on what is causing the disruptions, from those who believe having the DEA setting “quotas” on how much manufacturers can make to the converse perspective from the FDA and DEA, who conclude that drug companies are not using all the APIs that have been allocated. Initial investigation by the American Society of Heath-System Pharmacists (ASHP) have shown “in 60% of cases (shortages), manufacturers do not know or do not provide reasons why their drugs fall into short supply”.

Generics, non-injectable and injectables, are an extremely important segment of pharmaceuticals. However, generic manufacturers face intense pressure to reduce prices and often face unpredictable revenues due to contract terms with CMOs. Many generics are produced in facilities set up for high-volume, low-cost; however, due to the need to produce product at the lowest cost possible, it reduces the available revenue for reinvestment into the process. This leads to a lack of investment in improved/updated equipment, the ability to reshore production, and not ensuring quality controls are in place. As a result, there’s a high level of generic drug discontinuation due to quality and reliability failures as well as loss of margin, making the product unprofitable for the company. Such disruptions have become more frequent and harder to manage and mitigate.

Managing and Mitigating Risk

Our recommendation for generic pharmaceutical companies correspond with those suggested by the ASHP’s, “Policy Solutions to Address the Drug Shortage Crisis” and the Department of Health and Human Services’ “Policy Considerations to Prevent Drug Shortages and Mitigate Supply Chain Vulnerabilities in the United States.” Using these as the foundation, immediate steps that generic companies can take are:

- Assess/update risk management strategy: Review and update existing the risk management plan, focusing on the assurance of a resilient supply chain that prevents, easily responds and reacts to, and recovers from disruptions, along with begin building/improving the predictability of supply chain risks.

- Employ strong supply chain processes: Implement a solid material planning and reconciliation process and Integrated Business Planning (IBP)/Sales & Operations Planning (S&OP) process.

- Improve data sharing: Leverage data to share and improve transparency on causes of shortages, reducing the vagueness in current reporting both up and down the supply chain.

- Implement/enhance Current Good Manufacturing Process (CGMP): Ensure company meets regulatory requirements, including their quality management system, performance, and patient focus related to the utilization of technology, statistical process control, and planning activities.

- Explore partnerships with 503B outsourcing facilities: Consider this as part of a broader mitigation strategy, particularly for high-risk or frequently shorted sterile injectables. These facilities can provide additional production capacity in line with FDA quality requirements, helping buffer against sudden supply chain failures.

- Investigate expire date extension: Conduct research and submit applications to expand the expiry date for product.

Clarkston Can Help

We welcome you to reach out to Clarkston Consulting to help you work through the assessment and/or implementation of these recommendations. We can support you in putting together a plan and actions to improve your shortages.

Learn more about our Life Sciences Supply Chain Consulting services.