Balancing Growth & Optimization in Uncertain Times

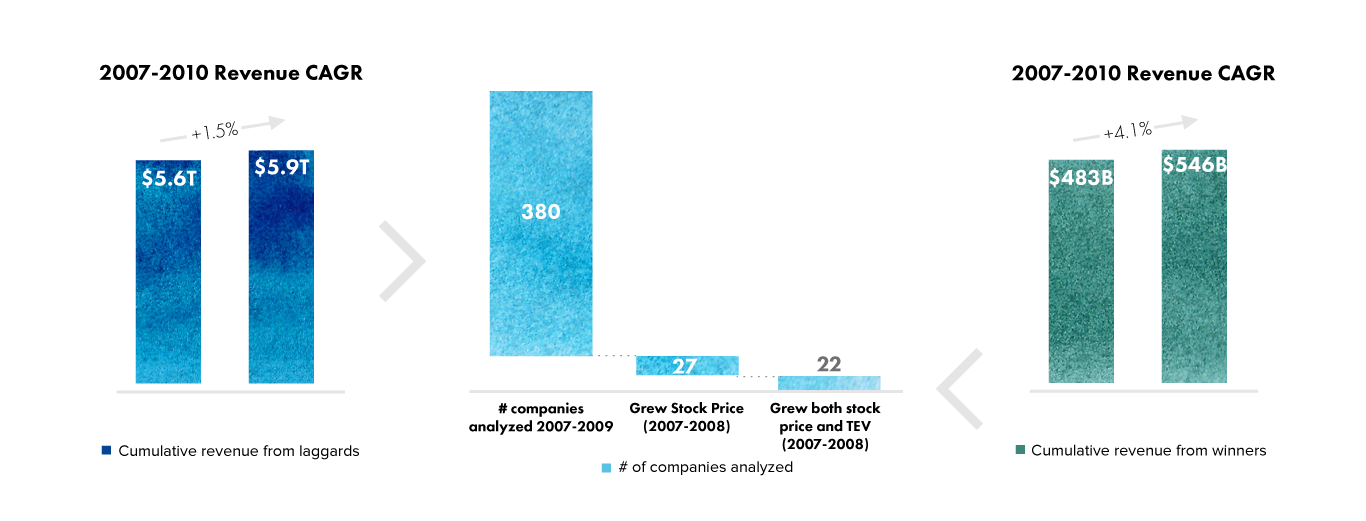

Growth and optimization in uncertain times is achievable, especially as we experience the impact from COVID-19. Traditional strategy teaches us that focus is the key to success. However, our research of the S&P 500 during the 2007-2009 recession suggests that companies with the ability to balance both growth and optimization in uncertain times – as opposed to focusing on just one element – have better odds of outperforming their peers in these tumultuous times. In fact, organizations that followed a set of five ingredients we identified in our research grew almost 2.8x faster than their peers (4.1% vs. 1.5% CAGR from 2007-2010) during the 2007-2009 recession (Figure 1).

Figure 1: Out of the 380 S&P 500 companies analyzed, 22 companies outpaced their peers by 2.8x during the last recession (2007-2010).

To learn from the best organizations around the world, we analyzed S&P 500 companies during the ’07- ‘09 recession. We wanted to understand which companies were able to outperform the market, and more importantly, what they did, as well as how and why they were able to do so.

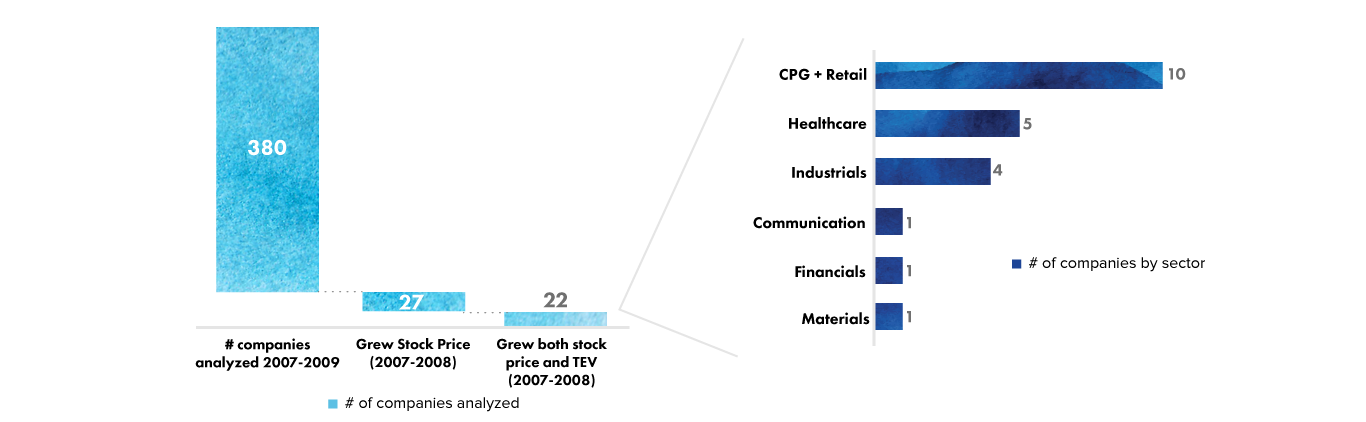

One early takeaway from our research was that there is no obvious, inherent trait or correlation amongst these companies – this means that any company can rise to become a market leader in a time of crisis. Though the strategic actions that led to growth may have been a result of some combination of proactive action and timing, they provide valuable insights about what a company can do to optimize during periods of uncertainty. Of the less than 6% of organizations who managed to grow both total enterprise value and stock price during the recession, 70% were categorized under the CPG & retail and life sciences sectors (figure 2).

Figure 2: Almost 70% of the 22 companies identified as winners during the 2007-2009 recession came from the CPG/Retail and Life Sciences sectors (see sidebar for approach & methodology).

We uncovered some obvious patterns in what made companies successful in the midst of this difficult environment. For Life Sciences organizations, a combination of well-timed M&A activity, robust product launch pipelines, and the right mix of commercial capabilities enabled winners to get their therapies to patients and grow faster than their peers.

In the Retail and CPG sector, brands that delivered on functional elements of the shopping experience (e.g., convenience, functional performance, and the right value equation) and connected with the customer on a deep emotional level were more successful than their peers.

Digging Deeper: Five Ingredients to Improve the Odds for Success of Optimization in Uncertain Times

These sector-related insights felt evident and somewhat superficial – so we pushed further in our research to find the common thread across sectors and organizations to zero in on the key traits that helped 6% of all organizations in our data to outpace their peers. To do this, we studied all publicly available information about these organizations to understand the nuances of their strategic initiatives.

We identified five success factors we call “ingredients” because companies across our research leveraged a unique mix of each element for their own success. Just like making a cake, different combinations of basic ingredients (like flour, sugar and eggs) and enabling tools and mechanisms (like temperature and time) create different outcomes, each unique to their own mix of ingredients.

Key Ingredient #1: Invest for the future.

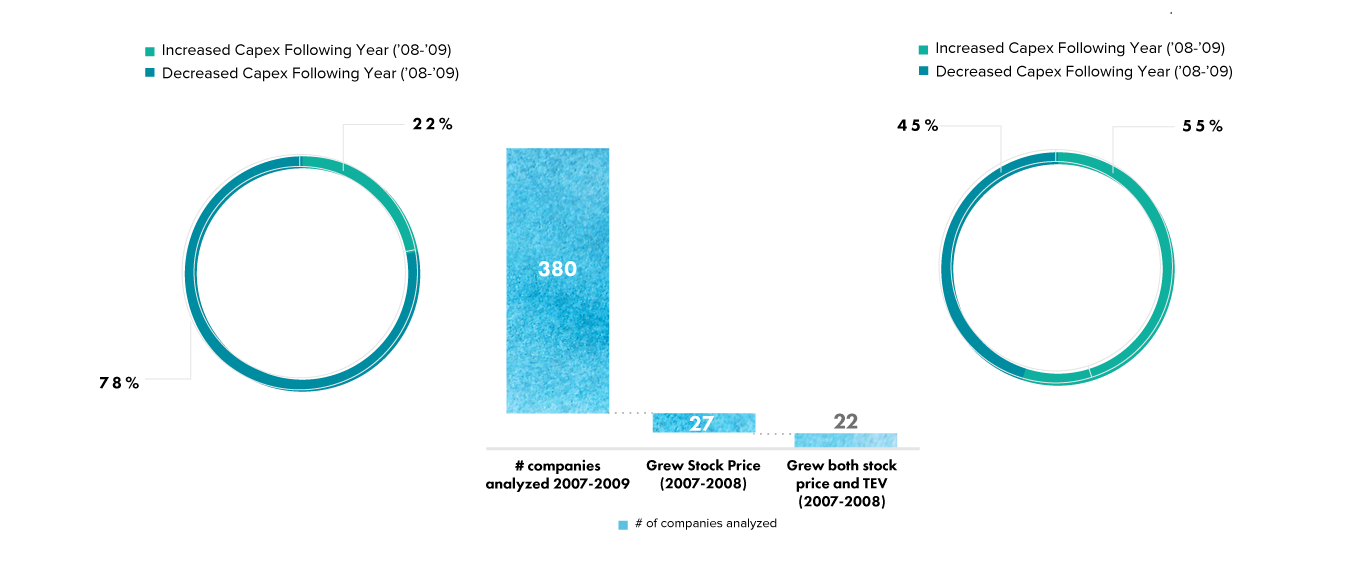

Companies that managed to balance daily operational needs with investments for the future fared better than their peers who restricted investments. For example, 55% of the companies that outpaced the market during the recession grew their capital expenditures year-over-year at the height of the recession, while only 22% of their peers did the same (figure 2).

Figure 3: 55% of the winning companies in our analysis grew their capital expenditures at the height of the recession, compared to only 22% of the laggards.

While companies tend to focus on optimization in uncertain times, leaders continued to find ways to invest and “double down” in areas they believed were critical to their success. In the case of one CPG organization, the company grew consumer marketing spending by 16% while SG&A also increased by 17% (i.e., there was no overt focus to offset investments with labor). In an environment where both consumers and retailers favored private label, this brand managed to grow share and retail penetration despite major headwinds. In another instance, a major pharmaceutical company continued to invest 40% of its total revenues into R&D to design and deliver disease altering therapies for unmet medical needs of incurable and debilitating diseases. In comparison, the average R&D investment for the industry at this time was approximately 17% of revenue. Both examples exemplify how organizations that successfully weather a crisis prioritize investment for the long-term, even when facing short-term challenges.

While companies tend to focus on optimization in uncertain times, leaders continued to find ways to invest and “double down” in areas they believed were critical to their success. In the case of one CPG organization, the company grew consumer marketing spending by 16% while SG&A also increased by 17% (i.e., there was no overt focus to offset investments with labor). In an environment where both consumers and retailers favored private label, this brand managed to grow share and retail penetration despite major headwinds. In another instance, a major pharmaceutical company continued to invest 40% of its total revenues into R&D to design and deliver disease altering therapies for unmet medical needs of incurable and debilitating diseases. In comparison, the average R&D investment for the industry at this time was approximately 17% of revenue. Both examples exemplify how organizations that successfully weather a crisis prioritize investment for the long-term, even when facing short-term challenges.

Key Ingredient #2: Drive new behaviors with KPIs.

Leaders focused on driving “new” behaviors by designating specific metrics and KPIs. “New” is the keyword to focus on in this case, since an organization must do things differently and implement new KPIs to push teams forward – whether moving in an entirely new direction, or heading down an expected path but in a significantly accelerated way. More importantly, in some cases leaders acted to model and promote these newly desired behaviors by visibly participating in them – in other words, they held themselves accountable to new behaviors. For example, one industrial products brand decided that the recession required the company to make a significant price increase to offset lower revenue and tightening market conditions. The company selected a 2.5-3% increase of 2009 pricing targets as the KPI for the executive leadership team’s annual incentive program. This was set at the C-suite level and communicated through 10-Q’ and 10-K’s to drive visibility with shareholders, but also to lead by example through a shared success commitment with all employees. In the face of unprecedented changes, leaders must set new and relevant guardrails that allow mobilization across the organization.

Key Ingredient #3: Execute as an agile organization.

Leaders must quickly adapt to changing conditions. The language used by the leading organizations we analyzed seemed to indicate adeptness at embracing uncertainty. Instead of trying to anticipate crises and develop reactionary plans, these companies created adaptive strategies, marked with visionary leadership as well as a combination of the other key “ingredients”. This well-articulated flexibility and transparency helped with planning through uncertainty.

One retailer that managed to quickly reposition during the recession focused on three main areas to pivot. First, they intensified their focus on fast-moving commodity products (as opposed to discretionary and/or durable goods) where they expected to see an uptick in sales even in a recession market. In doing so, the company shifted away from focusing on high-priced specialty equipment towards consumables. Second, they boosted their credibility by introducing nationally recognized brands to their product mix to create trust and credibility with consumers at a time of uncertainty. Third, the company shifted their TV advertising spend and reinvested a portion to enhance direct digital communications, with a focus on CRM. All three actions combined led same-store transactions to grow by 5% at a time when the market was headed in the opposite direction. Leaders were able to quickly adapt and make swift – and often nuanced – changes to their go-to-market approach, successfully capitalizing on changing market conditions. For large organizations, moving fast is not just a skill, it is a necessity.

Key Ingredient #4: Simplify the strategy.

Developing a clear, easily understandable strategy that passed “the napkin test” seemed to be commonplace for most winning organizations during the downturn. The simplicity of the message, the consistent and transparent communication, and a well-understood direction for where organizations needed to go allowed winners to move in unison towards a shared common goal.

A strategy must be clear to successfully connect the boardroom’s goals to the actions of the frontline as they interact with customers daily. In our analysis, we found that this often occurred through multi-year strategic imperatives that allowed organizations to “flex” capabilities depending on conditions. For example, one major CPG had created a cost-savings initiative 5-years prior to the recession. The strategy (a simple 3-letter acronym) was simple, clear, and concise in terms of what it needed to achieve: take costs out by reducing non-value-added activities. This imperative drove behaviors that could be easily and specifically tracked with KPIs. The goal was implemented and embedded across functions throughout the company’s operations, in plants, product development, marketing, insights, and other departments. The company’s strategic simplicity allowed them to offset record setting commodity inflation (over 9% in one year) during the recession, in turn keeping gross margin flat. Leaders were able to clearly articulate their strategic imperatives in ways that were balanced with the right levels of execution (and vice versa).

Key Ingredient #5: Articulate a common & shared purpose.

A fifth ingredient that provides cohesion across all other ingredients revolves around how the leading organizations united their actions to serve a broader shared purpose. It is this purpose that served as a “north star” that helped them navigate turbulent times while staying focused on the tasks at hand.

For example, the opening page of one Life Sciences company’s annual report focused exclusively on highlighting four individuals out of their 4,000 employees. They emphasized their drive for collaboration as a team, as they worked toward a common goal of discovering therapeutics for life-threatening diseases. This demonstrates a broader sense of connection and desire to contribute to the well-being of people in need, and a sense of pride in perfecting daily processes to deliver new treatments for patients. All of these individual perspectives led to one singular focus: striving every day to do what they could to help people around the world living with unmet medical needs. To support their purpose, in 2009 this organization increased the number of patients it supported in the developing world by 64%, doing so via substantially reduced pricing and licensing partnerships with local drug manufacturers.

Another CPG company had contributed 5% of pretax profits to a variety of causes over many years. Despite the recession, in 2009, the company grew its donations by 4.5% year-over-year and donated $91M. Rather than right-sizing the commitments to the communities it serves, this organization focused on the long-term value created through this symbiotic relationship between company and community.

Both examples show how purpose and shared commitments for leading organizations do not falter, but instead increase during difficult times. Paired with the other four “ingredients”, a company’s common and shared purpose can act as the glue that holds together organizations to get them through tumultuous times.

Look to the Past to Move Into the Future

Unexpected changes and disruptions – whether in a crisis or through longer-term market and competitive tectonic shifts – will undoubtedly test every aspect of an organization’s DNA and will to survive. However, entering a crisis is not the time to figure out who you want to be – instead, it is a time to reinforce the fundamental pillars and guardrails that hold true no matter what difficulties an organization may face.

Much like a sailboat in a storm, an organization’s engine – its “sails” – have to use the prevailing winds to their advantage. A storm will test the tensile structure of a sail, the strength of a boat’s hull, and the endurance & will to survive of its sailors.

By looking back at what was, at the time, one of the worst economic recessions in the history of humanity, we hope to provide clients with a different lens to look through the fog of this crisis and into better weather. We also hope this reassures that growth & optimization in uncertain times is achievable.

Subscribe to Clarkston's Insights

Contributions by Courtney Loughran.