What Inflation Really Means for CPG Companies and Consumers

Over the last few years, inflation has been a focal point of the U.S. economy and a prominent concern of U.S. consumers. Whether labeled as part of broader economic challenges like “strengthening the economy” or discussed in more casual settings, one thing is clear: the average American is acutely aware of rising prices on everyday essentials. In this piece, we provide insight into inflation and its impact on both CPG companies and consumers.

U.S. Inflation Drivers

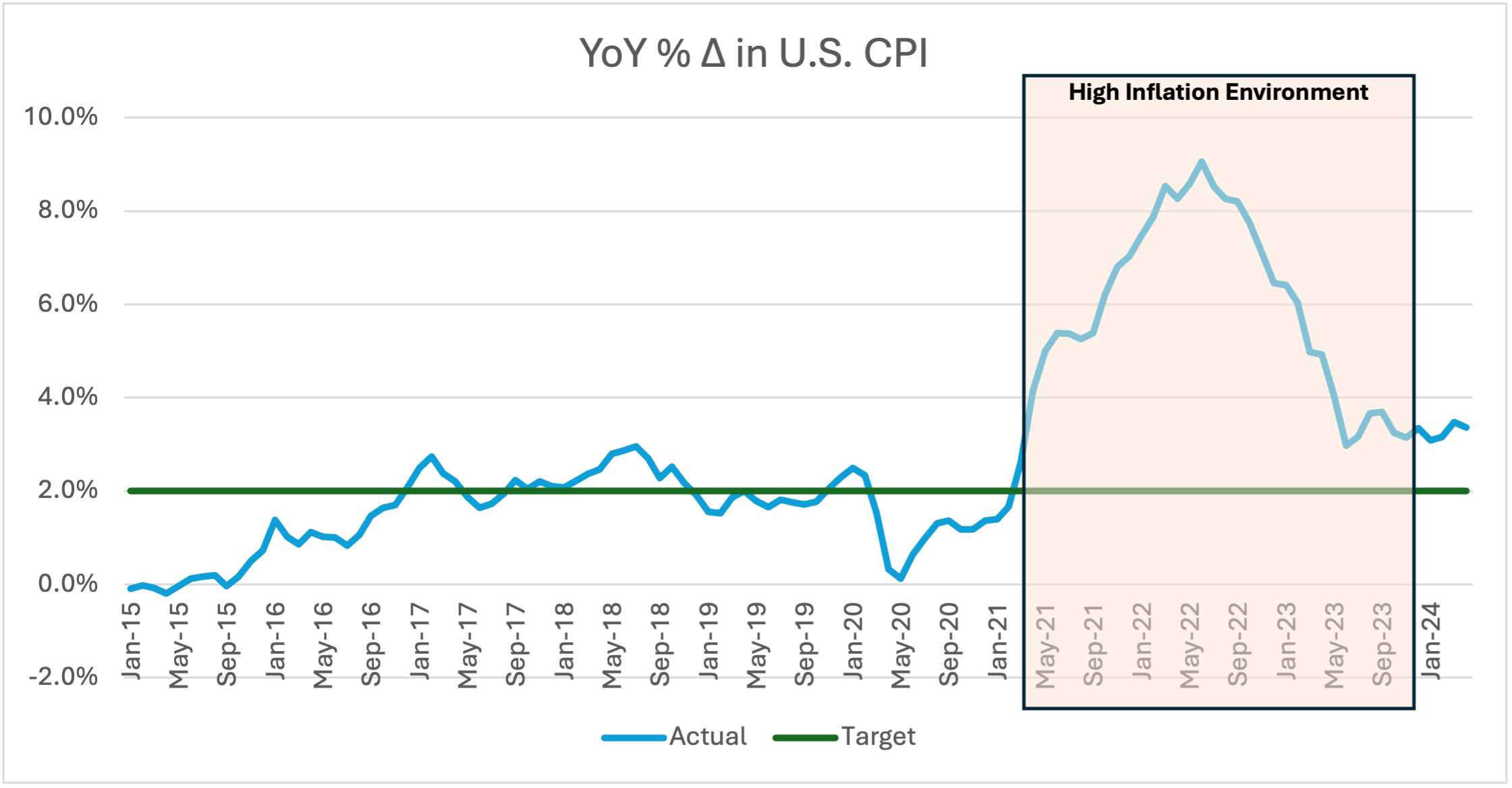

In April of 2021, the year-over-year percentage change in the U.S. consumer price index reached 4.2%, which is double the Federal Reserve target of 2.0%. This inflation continued to creep up to a height of 9.1% in June of 2022.

SOURCE: Federal Reserve Data

SOURCE: Federal Reserve Data

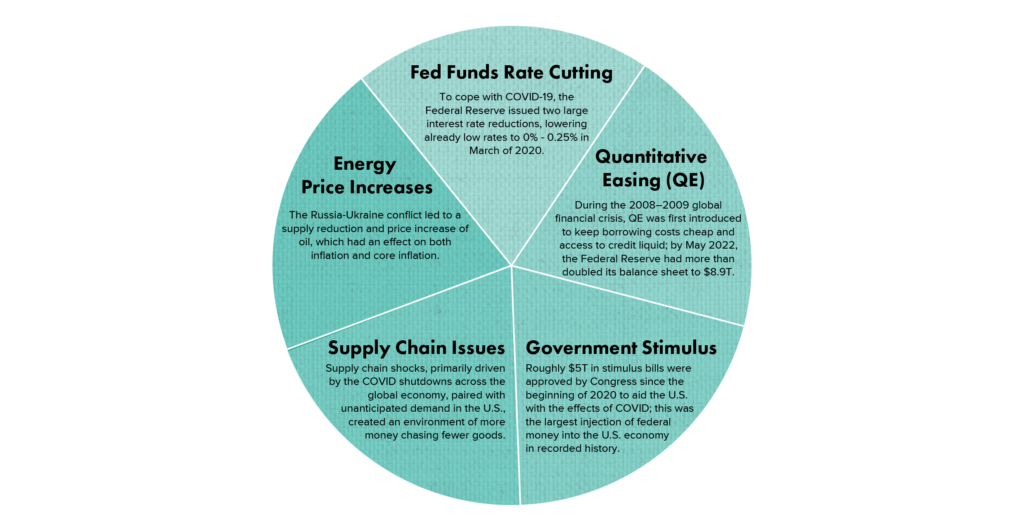

There are several factors, leading up to April of 2021, which created the perfect storm for a high inflationary environment:

Mechanisms for Inflation Reduction

Regardless of the factors that contributed to an increased money supply, the Federal Reserve has two primary mechanisms for reducing inflation: retiring U.S. debt and raising the fed funds rate.

Regarding U.S. debt, by the end of March 2024, the Federal Reserve had reduced its assets from a height of almost $9 trillion to $7.4 trillion. As of May 2024, the Federal Reserve stated that it will reduce its repurchasing of debt to $25 billion a month, starting in June of 2024, which is significantly lower than its previous amount of $60 billion a month. The Federal Reserve will likely end this quantitative tightening at the end of 2024 or early 2025.

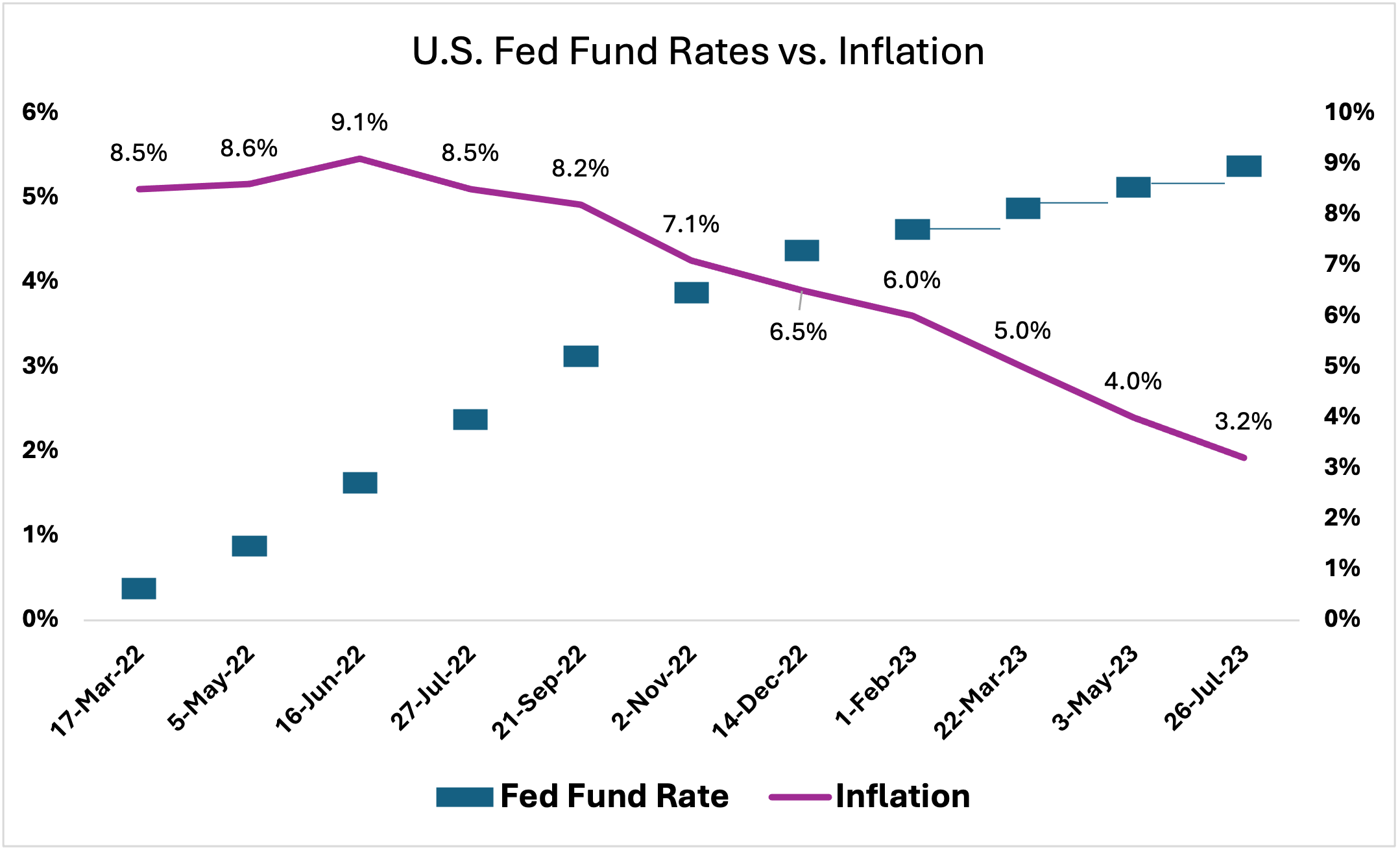

Since March of 2022, the Federal Reserve has steadily increased rates from a range of 0.25% – 0.50% to a range of 5.25% – 5.50% in July of 2023. For context, this is the highest it has been since January of 2001, when it rocketed to 6.00% in the wake of the dot-com bubble bursting.

It is also important to understand that the consensus among economists is that it typically takes a full year, if not longer, for one rate hike to make its way through the entire economy. This means that the full effect on inflation has not been felt yet, and neither has the full effect on consumer borrowing costs. Consumers may be watching to see when interest rates will be lowered and holding off on large purchases with associated borrowing costs. Since the slew of hikes in the last two years, for example, the average credit card interest rate increased from 16.34% in March 2022 to nearly 21% in April 2024.

The Federal Reserve measures of raising the fed funds rates and quantitative tightening have helped to reduce inflation. The Federal Reserve will begin lowering rates, but the timing is uncertain. Some economists have stated that rates will not be lowered until March of 2025.

Source: Federal Reserve Data

Source: Federal Reserve Data

Inflationary Effects on Consumers

Understanding that inflation is a top concern in the current economic environment; how has inflation truly affected consumers? Although inflation has come down to a 6-month average of 3.3% since its height of 9.1% in June of 2022, the cumulative effect of inflation cannot be understated.

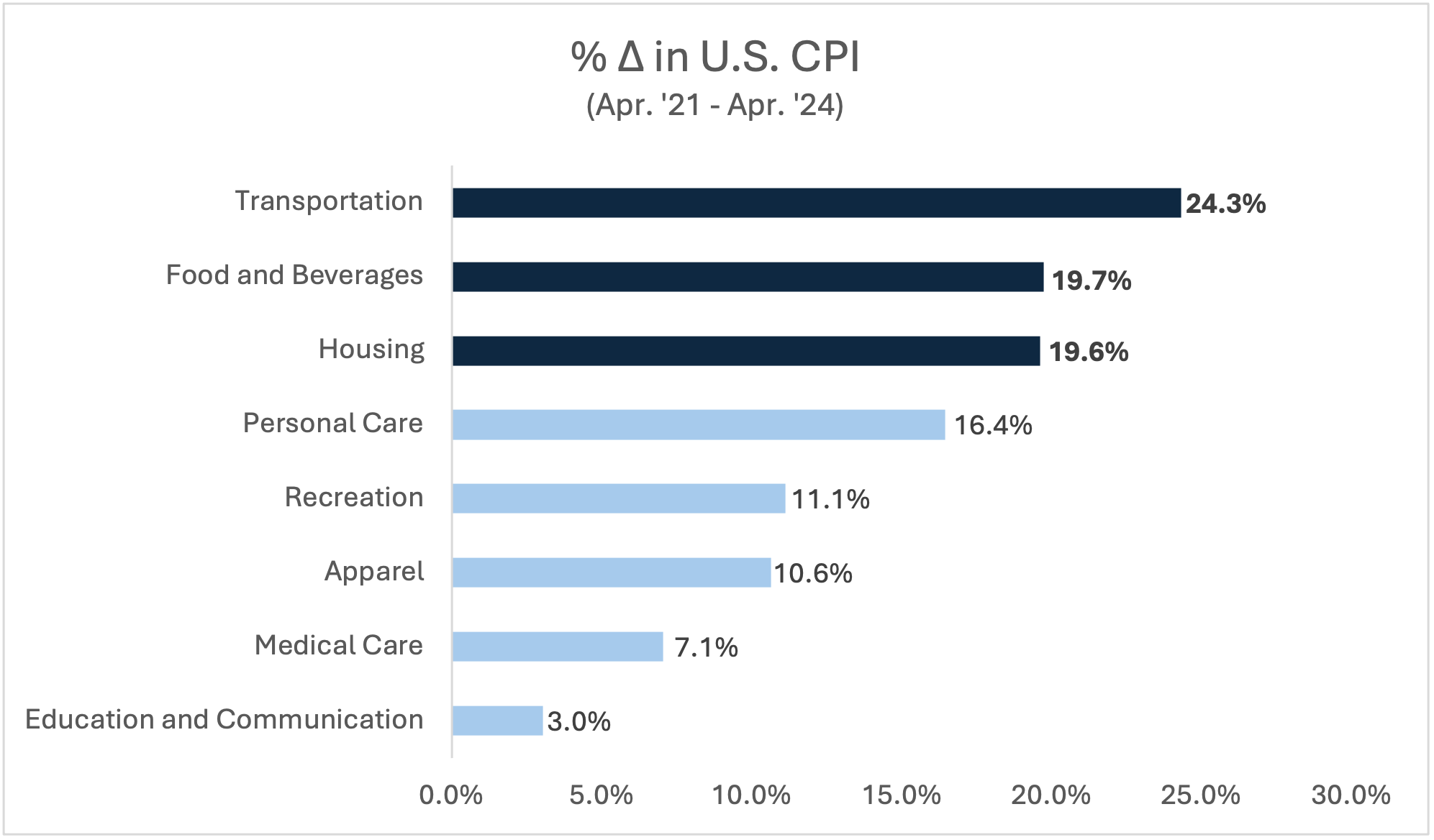

Since the U.S. has a target of 2.0% and looks to avoid deflation; consumers know that once prices increase in a higher inflationary environment, they will not come back down. To quantify what consumers have been feeling and reacting to, from April of 2021 to April of 2024, the consumer price index rose by 17.4%, resulting in a significant decline in purchasing power. If inflation remained at the target rate, the increase would have been 6.1%. Additionally, wages have not risen at the same rate, as the ECI (Employment Cost Index) rose approximately 14.1% during the same period.

When looking at categories of spend, the top three in terms of CPI increases are transportation, food and beverages, and housing. Transportation and housing are compounded by higher borrowing costs.

Source: Federal Reserve Data

Source: Federal Reserve Data

Moving beyond actual price increases, one of the most important dynamics to understand is: What inflation has done to consumer confidence, which is a leading indicator for consumption. Although the CCI (Consumer Confidence Index) in the U.S. has dropped significantly from its height in of almost 140 in the middle of 2018, it still has hovered above 100 for the duration of the high inflationary environment. Anything above 100 indicates a positive, forward-looking perception of household consumption based on a general attitude about the economy and the consumer’s financial position.

But what has all this meant for actual consumption?

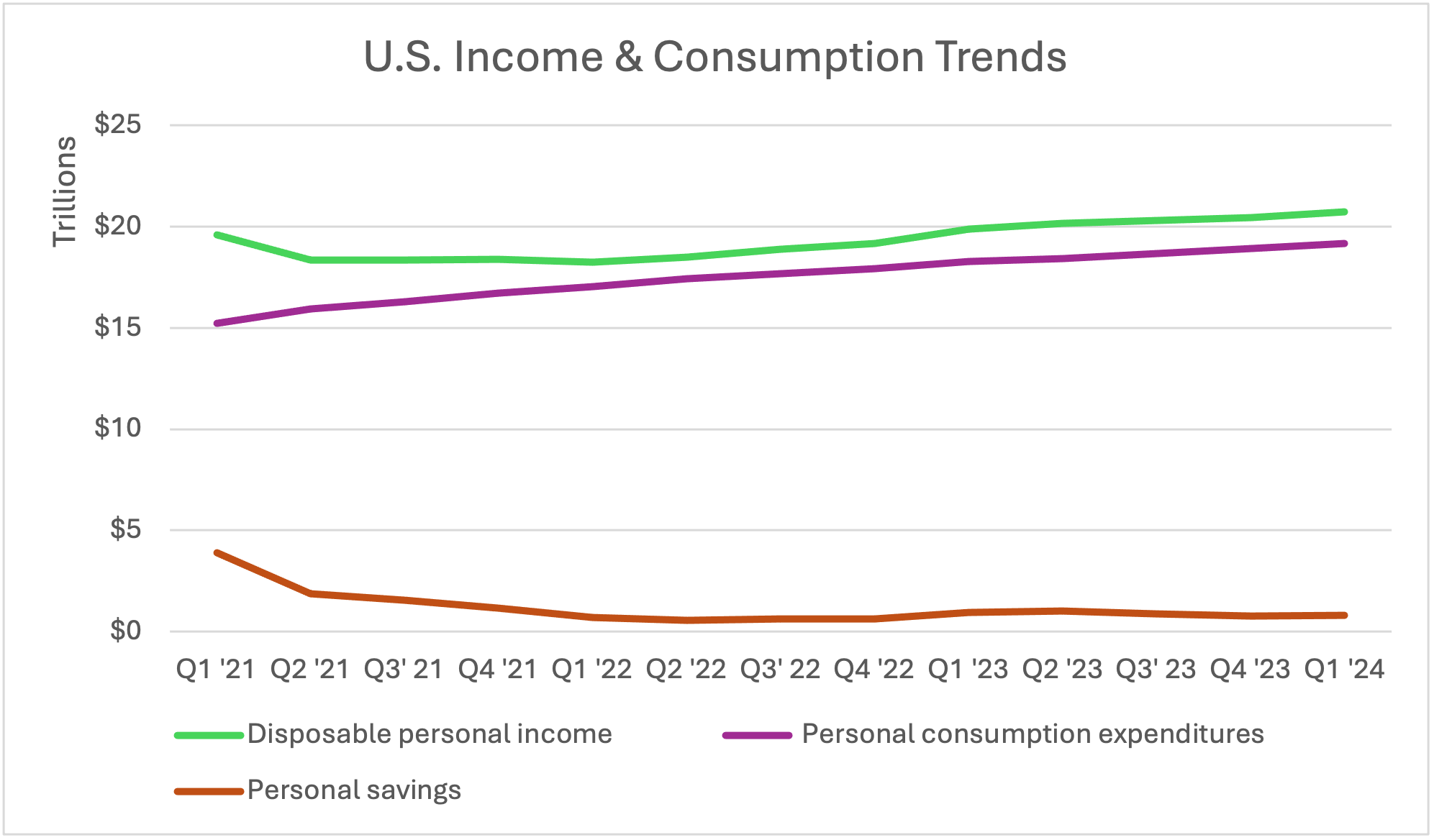

Again, from April of 2021 to April of 2024 the consumer price index rose by 17.4%, resulting in a decline in purchasing power. However, during the same period, disposable income rose by only 5.8%. Consumption increased by 25.9%, while savings decreased by 79.5%. Of course this is a macro view, and there are nuances to understand among different populations, but one thing is clear: Despite the effects of high inflation since April of 2021, consumers have spent at a rate that outpaced inflation.

Source: Federal Reserve Data

Source: Federal Reserve Data

What This Means for CPGs & Retailers

Overall, the effect of inflation on the CPG industry was driving down margins and leading to a volume contraction. Across CP categories, consumers are spending more and buying less: in 2023, Americans spent and additional 10% on groceries but purchased 4% fewer items. This translated to increases in sales but added pressures on profitability. From 2021 to 2023, CPG industry revenue increased by a 6% CAGR, while EBITDA decreased by 57 basis points.

As we come out of this inflationary environment, CPG companies should anticipate two challenges: finding areas for growth when opportunities are limited and optimizing their cost structures when many companies have already optimized operating models. CPG companies that fair well will do so through optimizing portfolios and performance. Primary areas for portfolio optimization can be achieved though M&A activity, reallocating resources to invest in growth engines, and exploring expansions into adjacent areas.

When enhancing performance, CPG companies will need to focus on commercial capabilities that will allow for increases in market share, expand markets, and increase brand equity. Additionally, companies must be willing to identify new cost-cutting opportunities through higher productivity and automation.

Clarkston’s CPG experts work with clients to leverage organic and inorganic levers of their companies. To set up a call for an initial diagnostic, please contact us today.

Subscribe to Clarkston's Insights